Neutral Indian Energy Exchange Ltd for the Target Rs.135 by Motilal Oswal Financial Services Ltd

Remain cautious as regulatory risk unfolds

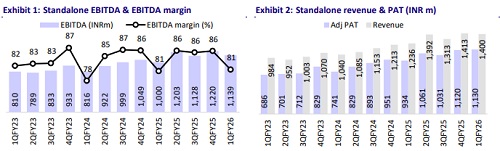

* Indian Energy Exchange (IEX) reported 1QFY26 standalone revenue of INR1.4b, in line with our estimate. Standalone PAT was 5% above our est. at INR1.1b, primarily due to higher other income. IEX’s electricity volumes increased 15% YoY and renewable (RE) volumes surged 149% YoY.

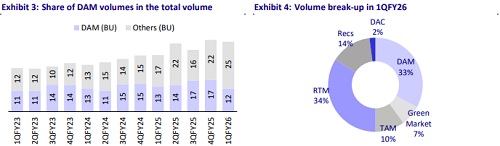

* Following a sharp 29% decline in its stock price over the past five trading sessions, the stock now trades close to its long-term average P/E of 28x. In light of the Central Electricity Regulatory Commission’s (CERC) announcement of the phased implementation of market coupling in India, starting with the day-ahead market (DAM) (~45% of IEX volumes in FY25) by Jan’26, we have lowered our FY27 earnings estimates by 17%, factoring in a 30% volume decline and a 10% fall in transaction fee in the DAM segment.

* While valuation has corrected sharply, overall the energy exchange space remains in a flux as the implementation of market coupling for DAM and other segments unfolds in the next few quarters, and this drives our cautious view on the space. We continue to like IEX for its competitive technological platform, robust new product leadership and strong management. We think near-term stock performance is likely to remain under pressure as competitive dynamics (fight for market share, re-defining of transaction fee) unfold in the sector.

* Key areas to monitor in the coming months include: 1) any legal recourse initiated by IEX, 2) practical challenges in operationalizing market coupling in DAM, 3) whether timeline for market coupling in DAM goes beyond Jan’26, and 4) roadmap for market coupling implementation in the RTM segment.

* We value IEX at a 28x FY27E EPS, in line with its long-term average, and reiterate our Neutral rating on the stock with a target price of INR135.

1Q broadly in line; PAT beats on stronger other income

* Financial performance:

* IEX reported standalone revenue of INR1.4b in 1QFY26, up 13.3% YoY and in line with our estimate.

* EBITDA came in at INR1.1b, up 13.9% YoY and 3% below our estimate.

* Standalone PAT stood at INR1.1b, up 21% YoY and 5% above our estimate, mainly on account of higher-than-expected other income.

* Operational performance:

* Electricity volumes rose ~15% YoY to 32.4BUs in 1QFY26.

* In the electricity segment, DAM volumes fell 7% YoY, whereas real-time market (RTM)/term-ahead market (TAM) volumes grew 41%/11% YoY.

* Renewable energy certificate (REC) volumes surged 149.3% YoY to 5.3MUs. Green Market segment also delivered strong volumes of 2.7BUs (50% YoY).

* In 1Q, higher hydro & wind and steady coal-based generation improved the supply liquidity on power exchanges. DAM liquidity rose 45.2% YoY, reducing prices by 16% to INR4.41/unit. RTM prices fell 20% YoY to INR3.91/unit.

* In the gas market, the Indian Gas Exchange (IGX) achieved record-high gas volumes of 24.6m MMBtu in 1QFY26 (+109% YoY), driven by increased demand from oil marketing companies and city gas distribution firms. Reported PAT for 1QFY26 grew 86.7% YoY to INR141m.

* International Carbon Exchange (ICX) issued over 4.4m I-RECs in 1QFY26, compared to 5.9m issued in FY25, and reported revenue of INR17.9m.

Highlights of IEX’s 1QFY26 performance

* Performance highlights

* IEX recorded electricity trading volume of 32.4BUs in 1QFY26, up 15% YoY, while PAT rose 21% YoY to INR1.1b.

* The exchange traded 5.3m RECs, achieved RTM volumes of ~13 BUs, and saw GDAM volumes grow 51% YoY to 2.7BUs in the quarter.

* In 1QFY26, IEX’s 74% of revenue came from transaction fees, 23% from other income, and the remaining 3% from admission and annual fees.

* DAM liquidity improved by 45.2% YoY, leading to a 16% decline in prices to INR4.41/unit, while RTM prices fell 20% YoY to INR 3.91/unit.

Other highlights:

* CERC issued an order on 23rd Jul’25 to initiate market coupling in the DAM by Feb’26, with GDAM inclusion remaining unclear.

* RTM coupling will be considered later due to operational complexities.

* Implementation will require extensive preparatory work, including software development, IT infrastructure setup, settlement mechanism design, and the formulation of market coupling regulations, which may take time.

* The company is still evaluating its options regarding the order, including proceeding with the implementation, seeking a review by CERC, or appealing to the Appellate Tribunal.

Valuation and view

* Our TP of INR135 for IEX is based on the following:

* We value the business at 28x FY27E EPS of INR4.9 in line with long-term average P/E of 28x.

* We have not assumed any value for IGX's stake in our valuation.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412