Add Siemens Ltd For Target Rs. 3,440 By JM Financial Services Ltd

Results modestly ahead; order inflow growth softens

SIEM topline exceeded our estimates by 8% however EBITDA beat was smaller at 5% on demerger linked costs. PAT beat was a modest 2% on higher tax and lower other income. Order inflows continue to be robust relative to peer ABB India at 10% though missed our estimate by 5%. We resume with ADD as we value the stock at similar multiples to ABB at 50x P/E Sep-27 as Digital Industries (DI) margin challenge still persist. We note change on FY end to March end vs Sep earlier makes direct comparison superfluous for FY26E numbers

* Execution beat largely led by Mobility (MO) and Smart Infra (SI) segments: Siemens sales at INR51.71bn (+16% YoY, +19% QoQ) beat our estimates by 8%. Significant portion of the beat was driven by MO at INR11.35bn (+29% YoY) and SI at INR27.25bn (+20% YoY) beating our estimates by 22% and 8% respectively with Digital Industries (DI) at INR10.67bn (+1% YoY) largely inline. Execution slowness in DI has been attributed by the management to weak existing order backlog and delay in pick-up in private capex. ? EBITDA margins impacted by Siemens Energy demerger costs; weak DI margins offset by multi-quarter high MO margins: Gross margins at 29.4% (down 50bp YoY/80bp QoQ vs JMFe at 31%) is weak. Overall EBITDA margin at 11.9% (vs JMFe of 12.3%) while stable QoQ was impacted by INR0.2bn of Siemens Energy linked demerger costs. Weak DI EBIT margin at 7% (down 230bp YoY and 370bp QoQ) (vs JMFe of 10.8%) offset strong MO margins spiked at 11.1% (+300bps YoY/730bp QoQ) (JMFe at 5%). The MO margins are at the highest levels since Mar’22 and is indeed a key surprise. EBITDA margin at 11.9% is stable QoQ despite the gross margin miss on strong operating leverage (employee and other expenses are inline).

* Order inflows growth healthy at 10% YoY though it missed our estimate: The order inflows at INR48bn (+10% YoY, -15% QoQ) while robust missed our estimate of INR51bn. While management is yet to disclose order inflow segment breakdown we believe DI inflows may have been weaker than expected as large ticket projects in private capex gets deferred. We note that ABB IN management had commented that Process Automation (PA) segment (similar to DI for SIEM) is witnessing ordering challenges as core sectors (steel, cement etc) defer capex. SIEM management hopes that private capex may recover following consumption buoyancy after GST rate cuts. We believe SI segment may have remained strong.

* For FY27 we expect SI and DI ordering to strengthen, SI margins may sustain and DI margins may revive in FY27: We believe strong prospects in data centres and building automation can continue to support SI related order inflows. Further, DI segment may be at its trough in our view both in terms of ordering and margins. We expect normalization on both fronts (ordering and DI margins) from FY27E (Mar’27 ending). In particular from Siemens Global presentation it appears DI ordering has improved in Sep’25 quarter on a subdued base. FY26 Siemens AG guidance suggests elevated SI/MO margins sustaining. In India Siemens has invested in Aurangabad to make it an export hub for MO segment.

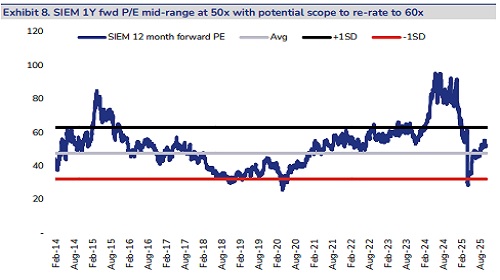

* Value at 50x (inline with peer ABB) on 1HFY27 P/E to derive a TP of INR3,440; resume with ADD : We prefer SIEM over ABB as ordering levels are relatively robust and based on Siemens AG commentary we believe there are scope for margin improvement in FY27. The stock trades at 48x FY27E EPS of INR48.2 which is attractive relative to peer ABB. Multiples are also similar to KKC vs an usual level of 20% premium (post Covid).

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361