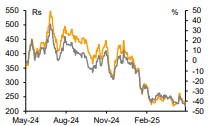

Buy Puravankara Ltd For Target Rs. 400 By Emkay Global Financial Services Ltd

Group CEO resigns; focus on growth to continue

Abhishek Kapoor, ED and Group CEO of Puravankara, has resigned as on 9-May25. This is likely to have a negative near-term impact on the stock, given that Kapoor’s contribution has been pivotal to the company’s scale-up in the last 3- 4Y. However, we highlight that his tenure as Group CEO in the last 4Y has seen formation of proper structure/teams/hierarchy, comprising of experienced regional CEOs, IT infrastructure, etc; this has fortified the company’s operations and foundation. Hence, we remain confident of Puravankara’s fundamentals and prospects. Puravankara, at all hierarchical levels, remains aligned with its strategy, designed to achieve growth over the medium term. Hence, the CEO exit is likely to be managed prudently. Nevertheless, we would monitor the management transition and continuity of the company’s execution prowess in this phase and beyond. We have not changed our financial estimates, though based on the Q4FY25 operational update and guidance (press release, media interview) we have cut FY26E/27E pre-sales by 11%/8% to Rs70bn/Rs93bn. We assign FY26E embedded EV/EBITDA multiple of 6x to the residential business. Accordingly, we retain BUY albeit cut our TP by 7% to Rs400 from Rs430. At CMP, the stock trades at 30% discount to the residential NAV.

Resilient corporate structure to have limited impact of CEO’s exit

Puravankara was already an established brand name in South India with strong recall, even prior to onboarding of Kapoor (in CY21). However, a proper structure for sustainable scale-up was missing earlier. When he assumed the role as the Group CEO in 2021, this void was filled thereafter, with setting up of the company’s different verticals with a more focused approach, and onboarding of several experienced personnel from the industry. This made decision-making more qualitative, streamlined, and efficient. Hence, despite Kapoor’s exit, we expect this structure and decision-making process to remain in place which would drive growth over the medium term.

Management level positions

Ashish Puravankara remains the Managing Director, and his leadership would continue to drive the company’s scale-up ahead, especially in the West. Mallanna Sasalu, head of the Provident Housing segment, is now CEO - South. His deep expertise and knowledge of the South India real estate market would continue to drive growth at an enhanced level. Rajat Rastogi (CEO - West) has strongly ramped up Puravankara’s presence in Mumbai and Pune; we expect his regional experience to further deepen the company’s presence in the West (he earlier did a stint with the Lodha Group and the Runwal Group).

Focus on growth continues

Along with changes at the management level, the company announced a new JV for developing a 24.6-acre land parcel in North Bengaluru which would have GDV potential of Rs33bn. This project is likely to be launched in FY26. The company has already added new projects with Rs130bn GDV in FY25 and, with this new project addition, growth visibility has improved. Also, we highlight that a launch planned in the current year gives positive indication on better capital churn.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354