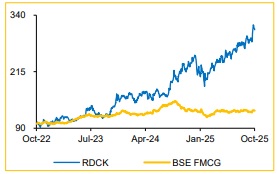

Add Radico Khaitan Ltd for the Target Rs. 3,340 by Choice Institutional Equities

New Route-to-Market Drives Volumes Higher: With the reopening of Telangana market and the free market approach adopted by Andhra Pradesh, RDCK has posted strong growth in these states. For AP, the market share improved from 10% in FY25 to 30% in Q2FY26.

View and Valuation:

RDCK reported a sharp increase in Popular segment volumes. However, as the base effect kicks in, growth in this segment is likely to slow down. Further, RDCK has managed to sustain its P&A momentum with 3 leading brands. Thus, we revise our FY26E estimates upwards by 2%, while maintaining FY27E/FY28E projection. We, therefore, maintain our TP of INR 3,340 using the DCF approach; this implies FY27E/FY28E PE of ~62x/48x with an “ADD” rating.

Strong Quarter: Big Beat on Margin – Expanding by 129bps YoY

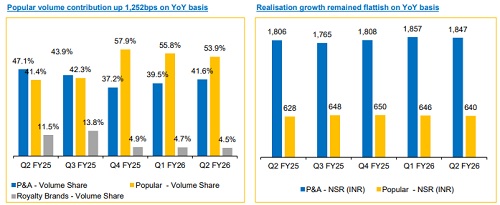

* Net revenue for Q2FY26 was at INR 14.9Bn up 33.8 YoY and down 0.8% QoQ (vs CIE est. at INR 14.7Bn) driven by a 21.7% and 79.6% surge in P&A and Popular category volumes, respectively.

* EBITDA stood at INR 2.4Bn, up 45.6% YoY and up 2.4% QoQ (vs CIE est. at INR 2.2Bn). EBITDA margin improved by 129bps YoY to 15.9%.

* PAT for Q2FY26 was at INR 1.4Bn, up 73% YoY (vs CIE est. at INR 1.3Bn).

Capturing the Ever-Changing Consumer

“Magic Moments” has shown incredible performance over the last 3 years, now commanding a market share of 60% of fast-growing Vodka segment. RDCK has also launched “The Spirit of Kashmyr” Luxury Vodka, which is available in 7 states. The refreshed “After Dark” Whiskey achieved a 100% YoY growth. Thus, we believe RDCK is well-poised to capitalise on the youth market.

Recent brand launches are expected to gain traction over the next 1–2 years. Sitapur Distillery, at present running at under-capacity, is expected to show consistent margin improvements at full capacity. Hence, while we believe RDCK is strongly positioned for growth and earnings expansion, we retain our price target of INR 3,340.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131