Buy Mrs Bector Foods Ltd for the Target Rs. 270 by Motilal Oswal Financial Services Ltd

Weak exports; domestic bakery & biscuit growth in line

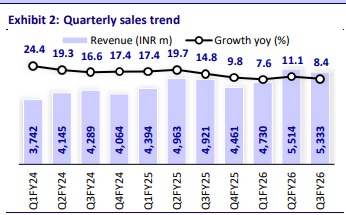

Mrs. Bectors Foods (MBFSL)’s consolidated revenue grew 8.4% YoY to INR5.3b in 3QFY26, led by strong performance in the bakery segment (+13.1% YoY, B2C – high teens and QSR – mid single digit). Biscuits grew at 5.5% YoY, led by high singledigit growth in the domestic segment, while exports reported low single-digit growth. According to the management, growth was largely volume-led, especially in English Oven and premium biscuits, indicating healthy underlying demand rather than pricing-driven expansion. Management expects a low-to-mid-teens growth, led by high-teens growth in Export & Bakery and high single-digit growth in QSR & domestic biscuits for FY27. EBITDA margin improved to 12.8% (+35bp YoY) despite export incentive suspension and labor code provisioning, with management reiterating its 14% margin target by 1HFY27. We expect Revenue/EBITDA/APAT to clock 13/16/19%, respectively, over FY25-28.

Bakery outperforms while exports struggle; domestic biscuits in line

MBFSL’s reported steady 3Q performance with revenue growth of 8.4% YoY to INR5.3b. Strong performance in the bakery segment (+13.1% YoY, B2C – high teens and QSR – mid-single digit) while biscuits growth moderated (+5.5% YoY, Exports – low single-digit and Domestic – high single-digit). The domestic biscuit portfolio is shifting toward premium and health-oriented products. B2B and QSR segments remained stable, with strong client relationships and rising contribution from frozen products. Export growth remained muted due to US tariff uncertainties and delayed project execution. Management expects a lowto-mid-teens growth, led by high teens growth in Export & Bakery and high single-digit growth in QSR & domestic biscuit for FY27. We expect Revenue/EBITDA/APAT to clock 13/16/20%, respectively, over FY25-28.

Margin improves QoQ, led by product mix; expect improvement in 4Q

In 3Q, gross margin came at 45.0% (-6bp YoY and +83bp QoQ, led by product mix), supported by softening input costs, particularly wheat flour and select edible oils. EBITDA grew by 11.4% to INR684m, settling EBITDA margin at 12.8% (+35bp YoY/+26bp QoQ), despite an increase in the employee costs (+9.4% YoY) and other expenses (+5.2% YoY). APAT grew by 10.1% to YoY to INR381m on account of lower interest expense (-9.0%). Management expects the gross margin to improve slightly in FY27 and reach 14% by 1HFY27.

Valuation and view: Upgrade to Buy

We expect MBFSL to deliver a 13% revenue CAGR over FY25-28, driven primarily by 1) strong growth in domestic bakery, 2) premiumization and health-focused innovation, and 3) growth in the export revenue after the reduction in tariffs. Domestic biscuits and QSR remain the weaker growth segments. Additionally, we believe distribution expansion in the domestic market (especially in Lower North) will be a key monitorable. Earlier we had NEUTRAL rating on this stock; however, following the correction since our IC, we have upgraded it to a BUY rating with a DCF-based TP of INR270 (based on an implied P/E of 34x on FY28). Key risks: potential supply chain disruptions impacting production and distribution/execution risks related to plant consolidation (refer to our IC note dated Sep’25)

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412