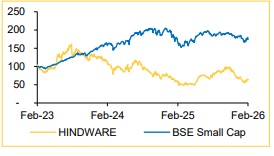

Buy Hindware Home Innovation Ltd for the Target Rs.380 by Choice Institutional Equity Limited

Management Initiatives Translating into Financial Performance

HINDWARE delivered a strategically constructive Q3FY26 result; strong traction was seen in its core Bathware business supported by premiumisation (premium mix ~40%), high capacity utilisation (80–90%) and higher ASP. The management guides for steady pipes growth (12– 15% volume). Overall, its strategy focussed on premiumisation, margin expansion, working capital discipline and market share gains in highmargin categories

Demerger Value Unlocking not Considered in Our TP

HINDWARE, in April 2025, announced the demerger of its loss-making Consumer Appliances Business. We have not factored in the benefits of the composite scheme of demerger, that is, 1) revising the valuation multiple of Building Products Business higher and 2) ascribing a positive value to the Consumer Products Business as the proposed demerger scheme receives requisite regulatory approvals. Based on Points 1 and 2, our proforma valuation workings (Exhibit 4) indicate a valuation of INR 480/share for the Building Products Business and INR 50 per share for the Consumer Appliances Business.

Valuation: We maintain our BUY rating on HINDWARE with a revised TP of INR 380/share (INR 430/share earlier). In line with revised estimates: 1) FY25–FY28E Revenue/EBITDA CAGR of 12%/29% for Bathware segment, 2) FY25–FY28E Volume/Revenue/EBITDA CAGR of 5%/5%/13% for Piping segment, driven by expected improvement in Real Estate and Infra activity and 3) FY26E/FY27E/FY28E EBITDA margin for Consumer Appliance business of 5.5%/6.5%/7.0%, owing to focus on profitable product categories. As a result, we arrive at FY25– FY28E consolidated Revenue/EBITDA CAGR of 9/44% (13/52% earlier).

Risks: Potential slowdown in real estate and home improvement activities and higher raw material cost are risks to our BUY rating

Q3FY26 Result Review: Improvement in KPIs Across the Board

? Consolidated revenue came in at INR 6,401 Mn (vs CIE est of INR 6,900 Mn), up 7.7%YoY (down 5.4% QoQ)

? Consolidated EBITDA came in at INR 482 Mn (vs CIE est of INR 660 Mn), up 63.8% YoY (down 14.6% QoQ). While EBITDA margin came in at 7.5% up 258 bps YoY (down 82 bps QoQ)

Segmental Results:

? Revenue from Bathware segment came in at INR 3,860 Mn, up 14.3% YoY (down 2.8% QoQ). EBITDA margin improved 15 bps QoQ to 10.4%

? Pipes segment reported degrowth of 8.3/13.1% YoY/QoQ in volume to 10.3 KMT. At the same time, realisation up 1.6% QoQ to 167/kg (down 0.3% YoY). As a result, revenue came in at INR 1,730 Mn, down 8.6/11.7% YoY/QoQ. EBITDA margin improved by 81 bps QoQ to 6.9%

? Revenue from Consumer Appliances segment came in at INR 815 Mn, up 20.0% YoY (down 3.5% QoQ). EBITDA margin came in at 1.2%, down 710 bps on QoQ

Important Disclosure

Analyst’s Coverage Transfer: The analyst’s responsibility for Realty, Infrastructure and Building Materials coverage has been transferred to Fenil Brahmbhatt. For HINDWARE, the recommendation remains unchanged, while the target price has been revised.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

Ltd.jpg)