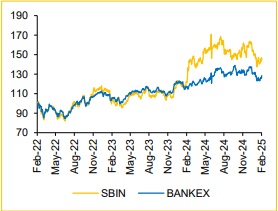

Buy State Bank of India Ltd For the Target Rs. 1,102 by Choice Broking Ltd

Resilient performance by “the banking behemoth” setting the stage for outperformance

SBIN reported subdued performance in Q3FY25, failing short of market and our expectations on few key operational fronts. The bank reported lower traction in loan portfolio but momentum picked up in deposit franchise. SBIN reported converging spreads with upward drifting C/I ratio. The bank made losses on its treasury and forex business. Asset quality continues to remain strong. SBIN in Q3FY25 reported:

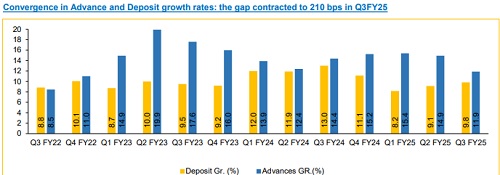

* Advances at INR 40,104 Bn (vs CEBPL est. INR 39,892 Bn), up 11.8% YoY while deposits grew 9.8% YoY to INR 52,295 Bn (vs CEBPL est. INR 51,510 Bn). CD ratio reported at 76.6%.

* Asset quality remains healthy as GNPA/NNPA improved by 32bps/10bps on YoY basis and 2bps/-2bps on QoQ basis. GNPA was reported at INR 844 Bn (vs CEBPL est. INR 828 Bn).

* PAT for Q3FY25 reported at INR 169 Bn, (vs CEBPL est. INR 188 Bn) was up by a staggering 84.3% YoY due to lower base previous year (due to INR 71 Bn one offs) but reduced 7.8% sequentially.

Treasury operations drags down profitability:

Income from treasury and forex segments were muted during the quarter. On sequential basis, MTM gains were down by ~INR 34 Bn and forex income plummeted by INR 10 Bn. We expect a rebound in these segments as India enters the rate cut cycle. Also, SBIN has strategically increased the modified duration of its AFS portfolio from 1.92 in Q3FY24 to 2.34 in Q3FY25.

One-off provision write-back cushions net profit:

SBIN reported provisioning of INR 9 Bn. The bank reported a provision reversal of INR 9 Bn and INR 5 bn on account of upgradation of COVID-19 restructured account to standard. Apart from this, credit cost related to NPA plunged to 0.24% from 0.39% from previous quarter. We expect the credit cost to normalize upwards going forward and settle at ~0.42%. Management has provided a 0.5% guidance across business cycles.

Potential for outperforming growth:

SBIN maintains a low CD ratio of 76.6% and a domestic C/D ratio of 68.9%. SBIN can sustainably grow its loan portfolio faster than its deposit franchise. We expect the banking behemoth to sustain its NIM above 3% even in falling rates scenario as advances outpace the deposits. SBIN maintains INR 4.83 Tn pipeline in just corporate banking segment. Loans worth INR 2.22 Tn have already been sanctioned and rest are under process.

View and Valuation:

We revise our FY25/26 ABVPS estimates upwards by 0.1%/2.9% and reiterate the ‘BUY’ rating. We maintain our TP of INR 1,102, valuing SBIN at 1.55x FY26 P/ABPS. SBIN is well positioned to capitalize on its extensive branch network and healthy C/D ratio of 76% to deliver loan growth higher than 15%. Management’s commitment and its consistent achievement of this commitment of ROA/ROE greater than 1%/20% since last 11 quarters underpins the strong earnings visibility. Despite near term margin compression, we expect NIM to remain above 3% as loan mix tilts towards higher yielding SME and retail loans. We expect SBIN to deliver ROE ~22% in FY26.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131