Neutral Info Edge Ltd for the Target Rs. 1,250 by Motilal Oswal Financial Services Ltd

Ltd.jpg)

Resilient execution amidst segmental divergence

Education business faces AI headwinds, diversification in progress

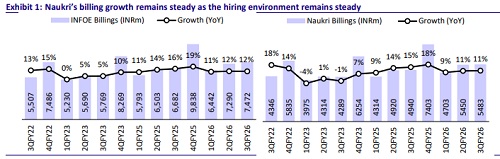

? Info Edge (INFOE)’s standalone revenue stood at INR7.6b in 3QFY26, up 13.9% YoY/2.5% QoQ, in line with our estimate of ~INR7.7b. EBITDA margin came in at 42.5% (up 290bp QoQ/down 60bp YoY), above our estimate of 38.8%. Total billings rose 11.8% YoY to INR7.4b.

? Adj. PAT was up 8.8% YoY to INR2.8b (vs. our est. of INR2.7b). This excluded a one-time impact of costs related to changes in labor codes of INR488m.

? In 9MFY26, its revenue/EBITDA/adj. PAT grew 14.3%/10.4%/10.1% YoY. In 4Q, we expect its revenue/EBITDA/adj. PAT to grow 11.5%/15.4%/12% YoY. We reiterate our Neutral rating with a TP of INR1,250, implying a 10% upside.

Our view: Investments in 99acres to drive further market share gains

? INFOE's recruitment business exhibited a mixed picture; revenue grew 14% YoY while billings remained broadly steady sequentially (~10% YoY growth). Healthcare and manufacturing continued to grow in double digits, while BFSI, retail, infrastructure, and consultant segments showed softness.

? Management indicated that hiring remains robust in the premium (>INR30 lakh CTC) and value (INR 5 lakh CTC) segments; however, the mid-segment (INR 5–30 lakh CTC) continues to see moderated volume growth, tapering to ~4% vs. 7–8% historically. Overall, we believe the hiring environment remains unchanged, with weakness in the mid-segment persisting and sectoral divergence likely to continue in the near term.

? 99acres sustained billing momentum, led by strong traction in the secondary (resale/rental) segment. The platform continues to gain supply share and improve traffic share (46% vs. 44% QoQ), positioning itself as a credible challenger in the large new projects market. We expect continued marketing investments to support share gains, though operating leverage may emerge gradually as revenue share expands.

? While the competitive intensity remains elevated in Jeevansathi, INFOE continues to strengthen its position in Hindi-speaking markets and leverage AI-led product enhancements to improve conversions and ARPU. Shiksha, however, faces visible AI-led headwinds, particularly in the domestic business where traffic has sharply declined. The company is pivoting towards counseling and marketing services to diversify revenue streams.

? Margins improved in 3QFY26 (standalone EBIT margin at 39.6%), aided by lower staff costs sequentially and moderation in marketing within Naukri. INFOE intends to continue investing in performance marketing across verticals, particularly in 99acres and Jeevansathi, to drive share gains. Within recruitment, investments in JobHai (a blue-collar job platform) and AI capabilities will continue as long-term strategic bets. We expect margins to reverse course in the next quarter (39% in 4QE) and settle ~36% in FY26/FY27E.

Valuations and changes to our estimates

? Our estimates are broadly unchanged. While INFOE’s businesses exhibit steady growth in recruitment and real estate, limited near-term profitability upside weighs on the outlook. In our opinion, the current valuations already reflect much of the expected growth, leaving little room for re-rating.

? We value the company’s operating entities using DCF valuation. Our SoTP-based valuation indicates a TP of INR1,250. Reiterate Neutral.

Revenue in line; margins beat our est.; billings up 12% YoY ? Standalone revenue stood at INR 7.65b, up 13.9% YoY/2.5% QoQ, in line with our estimates (~INR 7.6bn).

? Overall billings rose 11.8% YoY and were INR 7.47b. Billings for Recruitment/99 Acres came in at INR 5.4b/INR 1.1b vs. INR 5.05b/INR 1.03b in 3QFY25.

? EBITDA margin came in at 42.5% (up 290bp QoQ/down 60bp YoY), above our estimate of 38.8%. ? Naukri’s PBT margin was up 350bp QoQ at 59.3%, while 99acres’ PBT loss percentage reduced 300bp QoQ to 17.3%.

? Adj. PAT was up 8.8% YoY to INR2.8b (vs. our est. of 2.7b).

? The board has declared an interim dividend of INR 2.4/share.

Highlights from the management commentary

? Tech, IT & BPM segments combined grew 14% YoY. GCCs grew 13%, Recruitment Consultants grew 5%, and Other Sectors combined grew 2%.

? Recruitment: Across these segments, the focus is on increasing hiring share and revenue per hire. The premium segment market size is small but growing rapidly, and the hiring share in this segment is increasing.

? Volume growth is robust in the premium and value segments. Mid-segment volume growth has moderated (earlier 7–8% about 4–5 years ago, now ~4%) and appears under pressure.

? 99acres: Platform investments supported further traffic share gains, with quarterly average traffic share at 46%. With consistent traffic share gains, accelerating response growth, and mid-teen billings growth in recent quarters, management believes it has outpaced the market and expanded both traffic and revenue share.

? Marketing strategies are helping grow traffic share, supply, and revenue share in the matrimony business, and this approach will continue.

? If revenue growth remains in the teens, margins can be maintained or improved. However, if growth falls to single digits, margins may compress.

Valuation and view

? We expect near-term recruitment growth to remain range-bound, as macro uncertainty and client caution – particularly in IT and consulting – keep overall hiring demand muted. Management’s disciplined investments in growth businesses such as 99acres and Jeevansathi are already showing progress, and we believe these businesses could scale up meaningfully over the medium term, adding to the group’s long-term value.

? We value the company’s operating entities using DCF valuation. Our SoTP-based valuation indicates a TP of INR1,250. Reiterate Neutral.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

2.jpg)