Add Gujarat State Petro Ltd For Target Rs.335 By JM Financial Services Ltd

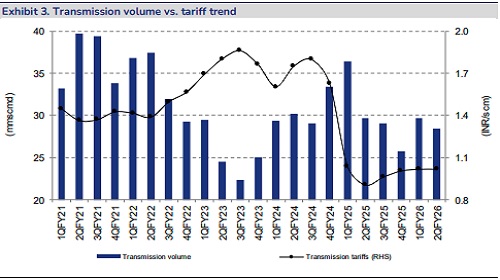

GSPL’s 2QFY26 standalone EBITDA was significantly lower at INR 1.7bn vs. JMFe/consensus of INR 1.9bn/INR 2.2bn due to lower transmission EBITDA margin at INR 632/tcm (vs. JMFe of INR 700/tcm) on account of higher opex and slightly lower transmission tariff. However, transmission volume was 1.1% above JMFe but down 3.9% QoQ at 28.5mmscmd. Further, PAT was sharply higher at INR 3.8bn vs. JMFe/consensus of INR 3.3bn/INR 3.2bn due to lower tax expense (at INR 0.4bn vs JMFe of INR 1.1bn). We maintain ADD (revised TP of INR 335) due to reasonable valuations - at CMP, GSPL is trading at 1.4x FY27 P/B (3-year average: 1.6x).

* Transmission volume was 1.1% above JMFe but down 3.9% QoQ at 28.5mmscmd: Transmission volume was 1.1% above JMFe at 28.5mmscmd (though down 3.9% QoQ and down 4.0% YoY) vs. JMFe of 28.2mmscmd led by slightly better volume from the fertiliser sector. The break-up of 1.2mmscmd QoQ decline in volume is: a) Power segment volume fell by 1.1mmscmd QoQ to 2.6mmscmd; b) others segment volume declined by 0.5mmscmd QoQ to 5mmscmd; c) Refinery/Petchem segment volume fell by 0.3mmscmd QoQ to 6mmscmd; d) CGD segment volume declined by 0.2mmscmd QoQ to 10.6mmscmd (driven by 0.2mmscmd QoQ fall in Gujarat Gas volume); while e) Fertiliser segment volume rose by 1mmscmd QoQ to 4.3mmscmd.

* Implied transmission EBITDA margin was lower at INR 632/tcm vs. JMFe of INR 700/tcm due to higher opex and slightly lower transmission tariff: Implied transmission EBITDA margin was lower at INR 632/tcm vs. JMFe at INR 700/tcm (vs. INR 714/tcm in 1QFY26) on higher cash opex at INR 772mn or INR 385/tcm vs. JMFe of INR 330/tcm (vs INR 633mn or INR 302/tcm in 1QFY26); further, weighted average tariff was also slightly lower at INR 1,017/tcm in 2QFY26 vs. JMFe of INR 1,030/tcm (and vs. INR 1,016/tcm in 1QFY26).

* Maintain ADD due to reasonable valuations: We have cut our FY26-28 EBITDA estimate by 1-4% to account for lower volume growth and slightly lower EBITDA margin; hence, our TP has been reduced to INR 335 (from INR 345). We maintain ADD due to reasonable valuations - at CMP, GSPL is trading at 1.4x FY27 P/B (3- year average: 1.6x). Our TP of INR 335 comprises: a) INR 100 for the existing pipeline business based on a DCF valuation, b) INR 215 for its 54.17% stake in GGas based on a 20% discount to CMP and c) INR 20 for its 27.5% stake in Sabarmati Gas based on 15x FY25 PAT.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361