Neutral SBI Cards and Payment Services Ltd For Target Rs. 780 By Yes Securities Ltd

Credit cost yet to improve

Spends/Receivable growth decelerate, NIM stable and Flows/Credit Cost remain elevated

SBI Cards’ performance in Q3 FY25 depicted continuous loss of Spends’ market share and sustained challenges of higher flows and credit cost. A further moderation in CIF growth (stood at 3% qoq/9% yoy) was precluded by higher new account acquisition in the quarter (11.75 lac - up 30% qoq/7% yoy). Customer selection and onboarding underwriting remains tight and the share of sourcing from SBI channel was at 55% in Q3 FY25 (versus avg. 44% in past 5 quarters). However, there was a marked sequential increase in sourcing of SE and Cat B Salaried customers and of accounts from locations outside the Tier 1/2 markets

Retail Spends growth decelerated to 10% yoy (from 23-25% yoy in preceding three quarters) owing to risk actions taken on the portfolio (spend/credit limits, etc. - annual spend/card has materially come-off) and calibrated account acquisition in past 12 months. Receivables declined 2% qoq with reduction in transactor balances (higher spends towards end of previous quarter) and the share of revolvers got reinstated to 24%. There was slight improvement in portfolio yield on account of receivables mix shift while the CoF was stable.

Annualized Credit Cost was higher at 9.4% (v/s 9% in Q2 FY25) with sustained higher flow rates from Stage-2 and increase in write-offs (jumped 22% qoq to Rs13.5bn). There was some decline in Stage-2 loans which the management attributed to improving trends in new delinquency addition. With further increase in credit cost, the annualized RoA/RoE made a new low of 2.4%/11.5%.

Key management comments – credit cost to slowly downshift and receivable growth to be 12-15%

Management expects credit cost to have peaked as along with the improvement in fresh delinquency addition there has been improvement in flows to the write-off bucket in recent months. Risk actions taken, strengthened portfolio monitoring and collections, and stronger quality of new acquisitions over the past 4-6 quarters should start normalizing the delinquency buckets (Stage-2/Stage-3) leading to gradual moderation of write-offs. We believe that the journey of credit cost normalization (from 9.5% to 6%) could be of 6-8 quarters at least (taking some reference from Covid cycle), provided the improving collection trends continue. Management expects receivables growth near 12% in the current year and around 14-15% in the next year. Further normalization of new acquisition run-rate is expected to drive an improvement in Retail Spends growth from the current moderate level.

Continue with Neutral stance; await better visibility of improving credit cost trajectory

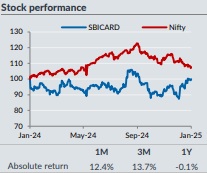

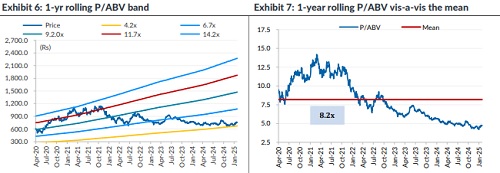

While indeed SBI Cards seems to be standing at an inflection point in its credit cycle, the demonstration of delinquency flow/write-off improvement in Q4 FY25 would provide confidence. Stock is trading at 18x P/E and 3.7x P/BV on FY27 estimates; hence, the valuation is not outright palatable. Key triggers for earnings upgrade and valuation re-rating remains a quicker-than-expected normalization of credit cost and swift decline in funding cost led by easing of rate cycle. The co. could deliver a significant cyclical recovery in RoE over the next couple of years. On relative benchmarking, we prefer BAF with its stronger (less-cyclical) growth and RoE performance and its valuation being similar to SBI Cards.

Please refer disclaimer at https://yesinvest.in/privacy_policy_disclaimers

SEBI Registration number is INZ000185632