Reduce Tata Communications Ltd For Target Rs.1,713 by Centrum Broking Ltd

Muted financial performance; Digital portfolio grew 10.2% YoY

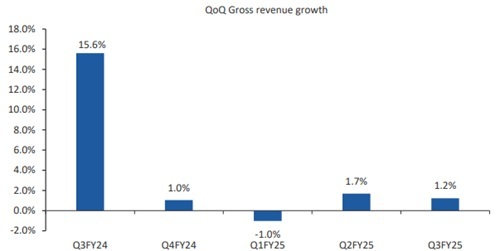

Tata Communications’ performance was below expectationsfor Q3FY25. Reported revenue stood at Rs58bn, up 1.2% QoQ. Segment-wise, Voice declined by 3.5% QoQ, Data grew by 1.4% QoQ while Others declined by 4.7% QoQ. Voice contributed 7.1% to revenue while Data contributed 84.6% to revenue. Digital portfolio contributed 47.2% to data gross revenue vs 45.9% in Q2FY25 and Core Connectivity contributed 52.8% to data gross revenue vs 54.1% in Q2FY25. EBITDA margin increased by 70bps QoQ to 20.4%, led by lower employee cost (down 4.3% QoQ) while it was dragged down by network cost (up 2.2% QoQ) and other expenses (up 1.7% QoQ). Capex stood at Rs4.9bn vs Rs4.5bn in Q2FY25. Net debt remained flat at Rs104.7bn vs Rs104.8bn in Q2FY25. Voice business would continue to decline as per industry trend. The Data business (led by the Digital portfolio) remains the key business growth driver for Tata Communications. Deal funnel addition has been robust but deal closure time has increased. It is expected to reach EBITDA margin of 23% by FY27. We expect Revenue/EBITDA/PAT to grow at 10.8%/16.2%/38.6% over FY24-FY27E. We roll over to March’27E for valuation and have revised our FY25E/FY26E/FY27E EPS by (11.0%)/(8.0%)/(4.8%). We maintain our REDUCE rating with a revised target price of Rs1,713 (vs Rs1,858 earlier) at EV/EBITDA of 8.5x (9x earlier) on March’27E

Revenue below expectation

Revenue grew by 1.2% QoQ. Segment-wise, Voice declined by 3.5% QoQ; Data grew by 1.4% QoQ; Others declined by 4.7% QoQ. Voice contributed 7.1% to revenue while Data contributed 84.6% to revenue. Digital portfolio contributed 47.2% to data gross revenue (45.9% in Q2FY25) and Core Connectivity contributed 52.8% to data gross revenue (54.1% in Q2FY25). Overall, the Voice business is expected to decline at ~6-7% CAGR; core data business has revenue growth potential of 4-5% CAGR, with the Digital business expected to grow at 15-20% CAGR. The company’s aim to double data revenue by FY27 over FY23 is on track, led by the growing deal funnel

EBITDA margin improves sequentially

EBITDA margin increased by 70bps QoQ to 20.4%, led by lower employee cost (down 4.3% QoQ) while it was dragged down by network cost (up 2.2% QoQ) and other expenses (up 1.7% QoQ). Divestment of the TCPSL business affected topline by Rs360mn and it boosted EBITDA margin by 40 bps. The aspiration remains to achieve 23-25% EBITDA margin in the medium term. We expect a gradual improvement in EBITDA margin to ~23% by FY27E.

Maintain REDUCE

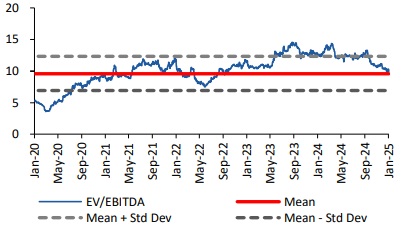

The financial performance was below expectation for the quarter. Data segment continues to drive overall revenue growth. It continues to augment its digital portfolio that includes Cloud, Collaboration, Security, Next Gen Connectivity (SD-WAN, IZO), CPaaS and Media Services while its cloud business has been mostly India focused. The revenue contribution from Voice business would continue to decrease going ahead. The rising mix of Digital data revenue would continue to drive overall revenue growth with EBITDA margin expected to increase to ~23% by FY27E. We expect Revenue/EBITDA/PAT to grow at 10.8%/16.2%/38.6% over FY24- FY27E. We roll over to March’27E for valuation and have revised our FY25E/FY26E/FY27E EPS by (11.0%)/(8.0%)/(4.8%). We maintain our REDUCE rating with a revised target price of Rs1,713 (vs Rs1,858 earlier) at EV/EBITDA of 8.5x (9x earlier) on March’27E

For More Centrum Broking Disclaimer https://www.centrumbroking.com/disclaimer/

SEBI Registration No.:- INZ000205331