Add Polycab India Ltd For Target Rs. 7,320 by Centrum Broking Ltd

POLYCAB’s consolidated sales rose 25% YoY to highest ever level of Rs69.9bn, above our/consensus estimate by 5% each. Wires & Cables segment grew 22% YoY led by healthy demand momentum across key sectors while FMEG sales grew 33% YoY due to growth across all product categories. Gross margin rose 20bps YoY to 25.5%. EBITDA margin rose 110bps YoY to 14.7% (above CentE of 12.3%) due to operating leverage, turnaround in FMEG and higher EPC margin (on a low base). PAT grew 33% YoY to Rs7.3bn and was much above our/consensus estimate of Rs5.5bn/Rs6.2bn due to beat on topline and operating margin. By FY30, POLYCAB targets: (1) W&C growth at 1.5x of industry (implying 15-20% CAGR) with 11-13% EBIT margin and >10% exports share (2) FMEG growth at 1.5-2x of industry with 8-10% EBIT margin and (3) Rs60bn-80bn capex infusion having 4x-5x asset turns potential. Ramp-up in exports and turnaround in FMEG profitability will aid in overall margin expansion. We increase our earnings estimates for FY26E/FY27E by 4-6% range. Retain BUY rating with a revised target of Rs7,320 based on 40x FY27E EPS.

Wires & Cables: Healthy volume growth drives topline; EBIT margin stays robust

Wires & Cables sales grew 22% YoY to Rs60.2bn with mid-teens volume growth (both in Q4 and FY25). Cables grew in high-teens and outpaced Wires growth, which was in high single digit. EBIT margin was robust at 15.1%, flat YoY, but up 140bps QoQ, led by operating leverage and better product mix (high margin category of Wires grew faster than Cables QoQ). FY25 EBITDA margin was at ~14-15%. POLYCAB retained its market leadership with share at 26-27% (+100bps YoY) of organized W&C market. Price hike by mid high single digit was taken in Q4FY25. Exports fell 24% YoY to Rs3.3bn due to roll-over of a large order to Q1FY26. However, with a strong order book from Europe, the Middle East and Australia, it expects to see material improvement going ahead (aiming for 10% of sales). Exports focus will be through three divisions: (1) catering to OEMs (2) dealers & distributors and (3) EPC team. Share of USA in total exports was in high teens in FY25 (vs. 40% in FY24). POLYCAB has concluded its distribution model rejig in USA and is now operating through a hybrid model. It doesn’t expect USA’s tariff imposition to have a negative effect as India’s effective tariff rate is lower than Asian peers. FY25 capacity utilization was at 70-80%.

FMEG: Broad-based growth across products drives topline; EBIT turns positive

FMEG sales grew 33% YoY to Rs4.8bn, led by broad-based growth across categories. Fans witnessed healthy growth on the back of premiumization (constitutes 18%/30% by volume/value), despite a delayed summer. Lighting sales saw strong volume/value growth despite price deflation. Healthy real estate demand drove sales of Switchgears, Switches and Conduit Pipes & Fittings. Solar Inverters grew 2.5x YoY. EBIT turned positive for the first time after 10 consecutive quarters (EBIT margin of 0.4%).

Other KTAs: (1) EPC sales grew 47% YoY to Rs6bn. EBIT margin rose 430bps YoY to 9.4%. (2) FY25 OCF at Rs18.1bn vs Rs12.9bn YoY. (3) Ex-cash NWC cycle was 63 days in FY25 vs. 65 YoY.

Maintain BUY with revised target price of Rs7,320

We expect POLYCAB to post 19.5%/17% Revenue/EPS CAGR over FY25-FY27E. Growth prospects for Wires & Cables remain strong, led by rising industrial, infra and real estate capex; enhancing POLYCAB’s market leadership, widest product portfolio and strong execution capabilities.

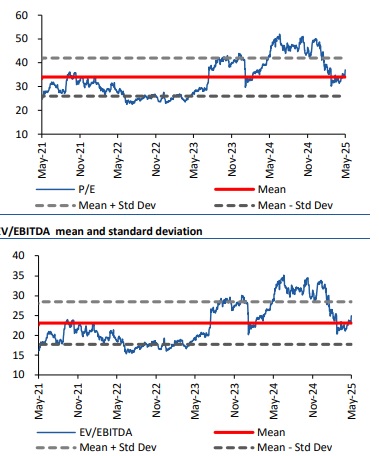

Valuation

We value POLYCAB at 40x FY27E EPS to arrive at a target price of Rs7,320.

For More Centrum Broking Disclaimer https://www.centrumbroking.com/disclaimer/

SEBI Registration No.:- INZ000205331