Buy Oil India Ltd For Target Rs. 525 By Yes Securities Ltd

EBITDA miss on higher opex while production stood in-line

Oil India’s earnings saw lower-than-estimated EBITDA and PAT on higher opex while the volumes and realizations stood in line with expectations. Crude production & natural gas both experienced YoY increase (but was lower than the company target due to less than planned contribution from wells. Depreciation, finding cost, and statutory levies showed increase, other expenses were higher than expected while other income included dividend income from its investments. We maintain a BUY rating, with a revised TP of Rs 525/sh, and find decent upside on current CMP.

Result Highlights

* Performance: EBITDA was at Rs 21.3bn up 1.3% YoY but down 2.3% QoQ. The adj. PAT at 12.2bn was down 22.9% YoY and 33.4% QoQ. The volumes were inline with our estimates, EBITDA was below our estimates on higher opex.

Stock performance

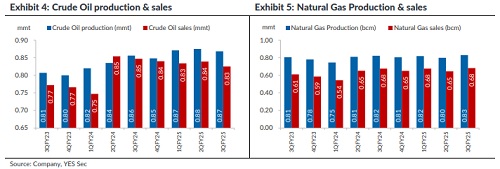

* Crude production and sales: the oil production was up 1.4% YoY but down 0.8% QoQ at 0.868 mmt (but was lower than the company target due to less than planned contribution from old, new and workover wells and LMD impact) marginally higher than our expectations. Oil sales were down 2.6% YoY and 1.7% QoQ.

* Natural gas production and sales: the production was up 0.9% YoY and 3.8% QoQ at 829 mmscm (but was lower than the company target due to less than planned contribution from old, new and workover wells and LMD impact). Natural gas sales were up 0.9% YoY and 5.7% QoQ. The sales as % of production improved to ~82%

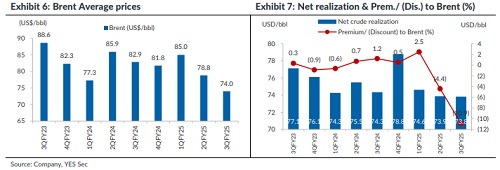

* Crude and Gas realization: Gross crude realization was down 12% YoY and 6.8% QoQ to USD 73.8/bbl, in line with the international brent prices, whereas gas realization was at USD 6.5/mmbtu. Net crude realization was down 0.7% YoY and flat QoQ to USD 73.8/bbl (No Windfall taxes in the qtr).

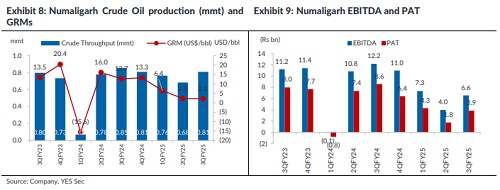

* Numaligarh Refining (NRL) performance: The performance showed recovery with EBITDA at Rs 6.6bn (vs Rs 4bn in Q2FY25 and Rs 12.2bn in Q3FY24). The PAT is at Rs 3.9bn, down 55% YoY but up 120% QoQ. The GRMs at USD2.1/bbl (vs USD2.3/bbl in Q2FY25 and USD12.7 in Q3FY24).

* Finding cost: as per our calculations, at USD17.2/bbl, it is higher than last 3-yr average of USD15/bbl. The statutory levies as a % of revenue stood at 25.4% (versus 26.2% YoY and QoQ).

* The other income at Rs 1.9bn (down 62.9% YoY and 78% QoQ).

* 9MFY25 performance: EBITDA/Adj. PAT at Rs 67.8/45.2bn vs Rs 69.2/58.9bn same period last year. Crude production was up 4.1% at 2.6 mmt, natural gas production was up 2.9% at 2.4bcm. Net crude realization was down 0.8% at USD 74.1/bbl.

* The company has declared 2nd interim dividend of Rs 7/share (Rs 3/shr earlier), a 36% payout for 9MFY25 with 17th Feb’25 being the record date.

Valuation

We maintain a BUY rating on Oil India, with a revised TP of Rs 525/sh, and find decent upside on current CMP. Our TP of Rs 525/sh comprises a) Rs 322/sh for the standalone domestic business, valued on 4x EV/EBITDA FY27e, b) Rs 165/sh for NRL on EV/EBITDA of 7.5x FY27e, c) Rs 38/sh for investment in listed equities, valued at 30% hold-co discount to market price.

Please refer disclaimer at https://yesinvest.in/privacy_policy_disclaimers

SEBI Registration number is INZ000185632

.jpg)