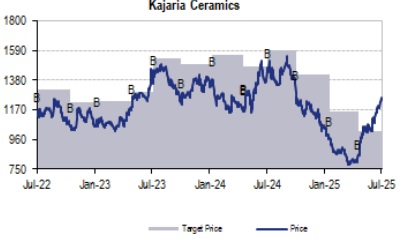

Buy Kajaria Ceramics Finance Ltd For Target Rs. 1,450 By JM Financial Services

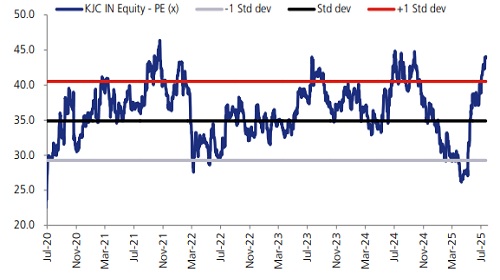

Kajaria Ceramics’ (Kajaria) EBITDA increased 9% YoY and 35% QoQ to INR 1.87bn with EBITDA margin increasing by 134bps YoY/ 562bps QoQ to 16.9% (JMFe: 14.0%). The margin improvement was driven by focus on cost reductions, optimisation of human resources and other corrective measures. Tile volume was broadly flat YoY, while realisation saw a marginal uptick of ~0.4% QoQ. The management is expected to prioritise cost rationalisation and incremental margin improvement over aggressive volume growth in FY26. The company is also progressing towards a unification strategy across ceramic, PVT, and GVT segments to streamline operations and drive cost efficiencies. In a further show of commitment, the promoters have voluntarily foregone their remuneration (INR 170mn in FY25, ~0.4% of sales) until the company achieves a four-digit annual EBITDA run-rate. Factoring in the 1Q outperformance and the company’s increasing emphasis on profitability and cost discipline, we revise our target P/E multiple to 36x (earlier: 30x) and increased our FY26-28 EPS estimates by 6-9%. Maintain Buy with revised Sep’26 TP to INR1,450/sh post half-yearly roll-over.

* Result summary:

Kajaria registered broadly flattish tiles volume YoY/ declined ~10% QoQ to 27.2mn msm; realisation dipped 1% YoY/ was broadly flat QoQ at INR 363/SQM. Revenue from the tiles segment was flat YoY at INR 9.9bn in 1Q as the company saw soft demand in both domestic and export markets. Bathware division revenue was flat YoY at INR 915mn while adhesives segment revenue increased by 64% YoY to INR 249mn in 1Q. EBITDA increased 9% YoY/ 35% QoQ to INR 1.9bn with EBITDA margin at 16.9% (JMFe 14%) mainly due to cost-reduction measures. Working capital days went up further by 7 days QoQ to 58 days in 1Q. Net cash increased by INR 910mn QoQ to INR 5.2bn as of Jun’25.

* What we liked:

Fall in total cost, and improvement in profitability; increase in net cash.

* What we didn’t like: Weak demand.

* Earnings call KTAs:

1) The company stated that differentiation between ceramics and vitrified tiles has become marginal in the market; it is working towards unification of sales teams; earlier, it had different teams for Ceramics, PVT, and GVT. Now, the company is forming a new strategy wherein a common team is expected to drive sales, volumes, help in streamlining operations and optimise costs.

2) The management stated that it will place greater emphasis on improving margin and reducing cost over volume growth in FY26.

3) The company also stated that the promoters will not be taking any salary in FY26 until it achieved run rate of INR 10bn EBITDA (salary of promoter for FY26 is INR 170mn).

4) The company has guided for adhesives division revenue of INR 1.2bn (EBITDA currently stands at 17%), while bathware is expected to achieve INR 4.8bn and is expected to turn profitable as well in FY26; losses from the plywood division have been largely accounted in FY25.

5) The management stated that gas prices had been broadly flat in 1Q;

6) The company guided for capex of ~INR 1.5bn for FY26 (partly due to a new corporate office); no major commitments on additional capacity are expected this year.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361

.jpg)