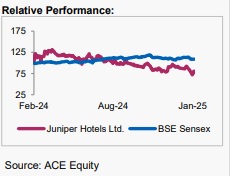

Buy Juniper Hotel Ltd For the Target Rs. 360 By the Axis Securites

Recommendation Rationale:

Juniper reported a 6.9%/17.7 QoQ/YoY growth, with ARR increasing to Rs 11,714 (+6.7% YoY) and occupancy reaching 75% during the quarter. However, certain key rooms that were out of service were restored early during the quarter, so the like-to-like occupancy rate would then be 77%. The luxury and upper upscale/upper segment reported RevPAR growth rates of 6% and 7% YoY, respectively. Occupancy for the upper upscale segment improved by 600 bps both YoY and QoQ.

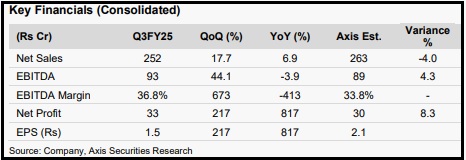

Consolidated margins stood at 36.8%, down by 410bps YoY but sequentially improved by 670 bps. The reported PAT of 33 Cr was up by 8x YoY due to savings in interest expenses.

Juniper's GMH, comprising 200 keys that were previously out of service, has now been fully refurbished and launched as “The Grand Showroom,” featuring approximately 49,000 sq ft for high-end MICE events.

Sector Outlook: Positive

Company Outlook & Guidance: The hospitality industry upcycle remains strong, driven by corporate demand, large events, and high-profile social gatherings. ARR growth continues in Jan’25, especially for Grand Hyatt Mumbai and Andaz Delhi. According to Horwath HTL's prediction, demand is projected to grow over 10% annually for the next 3-4 years, while supply, at 7%, will continue to lag behind demand. Foreign Tourist Arrivals (FTA) reached 92 Lc in FY24, and corporate travel expenses under MICE remain below pre-COVID levels.

Current Valuation: EV/EBITDA 17x for Sep FY27E earnings.

Current TP: Rs 360/share (Earlier TP: Rs 380/share)

Recommendation: BUY

Financial Performance: Juniper Hotels reported consolidated revenue of Rs 252 Cr, reflecting a 6.9% QoQ and 17.7% YoY growth, aligning with expectations. EBITDA stood at Rs 93 Cr, marking a 4% YoY decline. In Q3FY25, the luxury and upper upscale segments reported RevPAR growth of 6% and 7% YoY, respectively. Occupancy in the upper upscale segment improved by 600 bps both YoY and QoQ. The hospitality business reported a 17.3% YoY growth, with ARR rising to Rs 11,714 (+6.7% YoY) and occupancy reaching 75% during the quarter. However, certain key rooms that were out of service were restored early in the quarter, meaning the like-to-like occupancy rate would have been 77%. Management announced a new hotel in Kaziranga (under the Hyatt brand), while details regarding the ROFO acquisition are awaited. Consolidated margins stood at 36.8%, down 410 bps YoY but improved sequentially by 670 bps. The company reported PAT of Rs 33 Cr, up 8x YoY, primarily driven by savings in interest expenses.

Financial Performance (Cont’d) Management remains confident of a strong rebound in the next quarter, as Jan’25 showed strong performance metrics for both Grand Hyatt Mumbai and Andaz Delhi, along with a sharp improvement in EBITDA margins. Additionally, they announced the completion of the Bengaluru asset acquisition (already accounted for in financials) and a new greenfield project in Kaziranga (116 rooms) with a CapEx of Rs 100 Cr, targeted for completion by 2029. Management also provided an update on the ROFO asset acquisition, mentioning an intimation letter from Saraf Hotels, though exact details are expected to be finalized by the end of Mar’25. For FY26E, the company aims to achieve adjusted EBITDA margins of 40-43%.

Outlook The hospitality industry upcycle remains strong, driven by corporate demand, large events, and high-profile social gatherings. ARR growth continues in Jan’25, especially for Grand Hyatt Mumbai and Andaz Delhi. With FTA at 92 Lc in FY24 and MICE travel improving, upcoming events like the World Cup hockey and Kabaddi championships should further boost occupancies. Management targets 40-43% EBITDA margins for FY26E and anticipates strong growth from new acquisitions, the Bengaluru asset, and the Kaziranga project. The ROFO acquisitions under evaluation could add further value.

Valuation & Recommendation The company's growth drivers are expected to strengthen significantly because of the revenue growth from the restoration of 200 keys at GMH, the newly launched showroom, and the upcoming hotel in Bangalore. We maintain our BUY rating on the stock and value it at an EV/EBITDA of 17x for Sep FY27E to arrive at a target Rs 360/share price.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633