Accumulate Ambuja Cements Ltd For Target Rs. 616 By Elara Capital Ltd

Inorganic growth takes a toll on margin

Ambuja Cement’s (ACEM IN) consolidated adjusted EBITDA stood at ~INR 8.9bn, below our/Consensus estimates of ~INR 14.5bn/14.9bn, respectively. EBITDA/tonne contracted by INR 243 QoQ versus an improvement reported by most peers (that have declared results so far). This underperformance was due to increase in volume from low-priced southern markets, weak cost structure of acquired assets and volume push by ACEM to gain market share. We expect volume ramp-up from acquired assets and completion of ongoing expansion projects to augur well for future volume growth. However, we cut our EBITDA estimates by ~20% for FY25E, ~14% for FY26E and ~10% for FY27E, to factor in weak Q3 performance. Thus, we lower TP to INR 616 from INR 707. As our TP offer an upside of ~18%, we revise ACEM to Accumulate from Buy.

Reported PAT stood at ~INR 21.2bn versus our/Consensus estimates of ~INR 6.4bn/6.6bn, respectively. PAT was inflated by:

1) government grant of ~INR 8.3bn in past years and 2) interest income recognition of ~INR 11.1bn previously. Adjusted for this, PAT was down ~72% YoY/59% QoQ to ~INR 2.3bn. Key positive in Q3 was robust volume growth, up ~17% YoY, among the highest in the industry. Cash and cash equivalents were ~INR 87.5bn as of end-December 2024 versus INR 101bn as of endSeptember 2024

Volume push from high-cost assets drags EBITDA/tonne to two-year low:

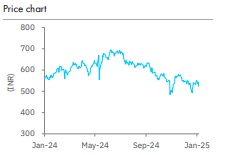

Consolidated sales volume grew ~17% YoY/16% QoQ to ~16.5mn tonnes, ~3% ahead of our estimates as Q3FY25 saw volume contribution from Penna Cement (PCIL) following completion of its acquisition in Q2FY25. Realization was down ~10% YoY/2% QoQ to INR 5,155/tonne, ~4% below our estimates. Operating costs rose ~2% YoY/3% QoQ to ~INR 4,618/tonne, ~4% above our estimates. We believe increased volume to low-priced South India markets, key market for PCIL, impacted realization whereas PCIL’s higher cost structure inflated overall cost for the company. Also, maintenance shutdown at select plants and increased spending on branding and marketing were other major drags on operating cost. Thus, EBITDA/tonne declined ~56% YoY/31% QoQ to INR 537 (the lowest since Dec ’22) versus our estimates of INR 908.

Revise to Accumulate; TP pared down to INR 616:

While ACEM’s near term performance is likely to be impacted by the low margin profile of the acquired assets, in the long term, it should benefit from the cost saving initiatives. We cut our EBITDA estimates by ~20% for FY25E, ~14% for FY26E and ~10% for FY27E, to factor in weak Q3 performance. As a result, we lower our TP to INR 616 from INR 707, based on 18x (unchanged) March 2027E EV/EBITDA. As our TP offer an upside of ~18%, we revise ACEM to Accumulate from Buy. Sub-par demand, weak cement price and a sharp rise in fuel price are key risks to our call.

Please refer disclaimer at Report

SEBI Registration number is INH000000933