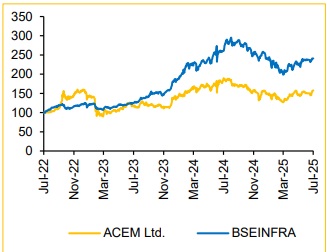

Buy Ambuja Cement Ltd For Target Rs. 700 By Choice Broking Ltd

Feedback from the 2-day visit to Ambuja (Management Meet & Plant Visit)

Ambuja Cement (ACEM) organized 2-day Analyst meet, where we interacted with management on the 1 st day and visited the plant (integrated clinker and grinding unit) and mines on the 2 nd day at Marwar. We incorporate our findings from the trip into our model.

We maintain our BUY rating on ACEM but increase our TP to INR700 as we factor in:

1) the volume growth of 12%/10%/10% over FY26E/27E/28E vs 10%/9%/9% earlier,

2) higher premium product share that will drive better realisation and,

3) INR400/t cost reduction benefit over FY25-28E vs INR 300/t earlier.

As a result, of 1 to 3 points above, our EBITDA/t estimates for FY26E- FY28E improve by 150/t vs our previous estimates. We now consider ROCE adjusted for non current investments, which increases from 8.0% in FY25 to 15.9% in FY28E. We now also incorporate value of the stakes held in Orient Cement & Sanghi Cement into our valuation framework. We incorporate a robust EV to CE (Enterprise Value to Capital Employed) valuation framework (Exhibit 4), which allows us a rational basis to assign a valuation multiple that captures improving fundamentals.

We forecast ACEM EBITDA to grow at a CAGR of 34.8% over FY25–28E, supported by our assumptions of volume growth at 12.0%/10.0%/10.0% and realisation growth of 1.5%/2.0%/0.5% in FY26E/FY27E/FY28E, respectively.

We arrive at a 1-year forward TP of INR 700/share for ACEM. We value ACEM on our EV/CE framework – we assign an EV/CE multiple of 4.5x/4.5x for FY27E/28E, which we believe is conservative given the increase of adjusted ROCE improvement of ~700bps over FY25-28 under reasonable operational assumptions.

Key Focus Area of Management

Aggressive capacity expansion to drive volume growth: At the end of FY25, Adani Cement (ACC+Ambuja+Orient+Penna+Sanghi) had a total installed capacity of 103 MnT, which it aims to expand to 140 MnT by FY28E. The company has planned a phased expansion strategy—Phase 1 includes a brownfield capacity addition of 17 MnT, followed by an additional 21 MnT, primarily through brownfield projects. This aggressive expansion pipeline is expected to drive a meaningful increase in Adani Cement’s market share—from 14% in FY25 to 17% by FY28E— strengthening its position as one of the leading players in the Indian cement industry

Prices expected to remain stagnant in the near term, due to early monsoon: Cement prices began to soften marginally in June 2025 due to the early onset of the monsoon. However, price hikes taken during April–May 2025—primarily led by the southern region—have resulted in an estimated increase of +4.2% QoQ and +2.8% YoY for 1QFY26E.

Cost optimization roadmap: INR 500/t reduction by FY28 to drive INR 1,500/t EBITDA target: ACEM is well-positioned to achieve its targeted total cost of INR 3,650/t by FY28, driven by multiple structural levers. Long-term raw material agreements (10 years) are expected to deliver ~INR 100/t savings. ACEM plans to increase its green power share from 21% to 60%, leading to a ~INR 280–300/t reduction in power & fuel costs. Logistics savings of ~INR 100/t are expected through a higher share of direct dispatch and increasing sea logistics share from 5% to 8% by adding 7 ships to its current fleet of 11 over the next two years. ACEM expects the majority of its cost savings to begin materializing from FY27E onwards, with the full benefits likely to be realized by the end of FY28E, helping the company reach its targeted cost levels. We expect ACEM, EBITDA/t to reach at INR 1,350/t by FY28E vs the management target of reaching INR 1,500/t.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131