Buy Tech Mahindra Ltd For Target Rs. 1,931 By Choice Broking Ltd

Q1FY26 better than expected; FY27E growth & margin aspirations intact

• Reported Revenue for Q1FY26 stood at USD 1,564Mn up 1% Q0Q (vs CIER est. at USD 1,550Mn). The CC de-growth was 1.4% QoQ, however on expected lines, the cross-currency tailwind of 2% mitigated the further top-line deceleration. In INR terms, revenue stood at INR 133.5Bn, down 0.2% QoQ.

• EBIT for Q1FY26 came at INR 14.7Bn, up 7.2% QoQ (vs CIER est. at INR 13.9Bn). EBIT margin was up 77bps QoQ to 11.1% (vs CIER est. at 10.5%).

• PAT for Q1FY26 came at INR 11.2Bn, down 2.2% QoQ (vs CIER est. at INR 11.9Bn) despite of strong margins as effect of one-time tax refund in Q4 got normalized in Q1.

Modest Top-line growth supported by Communications vertical: TechM reported Q1FY26 revenue of USD 1,564Mn, up 0.4% YoY but down 1% in CC. TCV of USD 809Mn modestly exceeded guidance of 600-800Mn range, up 1.4% QoQ, with wins spread across Communications, Hi-tech, and BFSI. The demand outlook remains dynamic and uncertain. Communications vertical led the growth in Q1 by 2.8% QoQ in USD term. Manufacturing declined 4% YoY due to automotive sector weakness and trade tensions, while Hi-tech fell 3.3% YoY on client restructuring and budget cuts. Conversely, Communications stabilized, rising 2.5%, and BFSI grew 4.7%, continuing strong momentum. Europe grew 11.7% YoY, aided by currency & consolidation tailwinds; North America declined 5.9% on Manufacturing softness. Management expects FY26 to outperform FY25, forecasting sequential growth from Q2FY26 onward, backed by past deal wins, & remains confident in beating peer average growth in FY27.

Turnaround gets prominent from consistent margin improvement: TechM reported its 7 th straight quarter of margin expansion, with EBIT margin rising to 11.1% in Q1FY26 from 10.5% in Q4FY25. This improvement came despite seasonal pressures from Comviva & higher visa costs. Key drivers included lower subcontracting expenses, increased offshoring, integration of portfolio companies, & better contract governance. SG&A optimization and a favorable offshore mix also supported margins. Management remains confident in reaching FY27 margin targets of 15%, contingent on their topline growth assumptions. Further gains are expected from productivity initiatives & ongoing integration efforts. However, we anticipate a conservative margin expansion to 13.5% by FY27E. Sales & support teams were streamlined from 14 units to 1 consolidated structure to reduce complexity without compromising sales intensity.

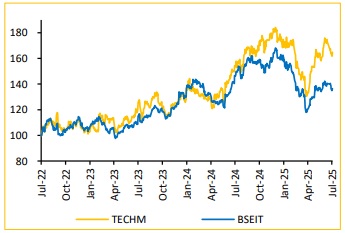

View and Valuation: TechM’s Communications vertical is set to stabilize & drive near-term growth, with additional long-term support from BFSI opportunities. However, Manufacturing & Hi-Tech segments face near-term challenges due to muted auto spending, semiconductor headwinds, & lower discretionary investments. Despite this, TechM is undergoing a strategic turnaround, evident in its steadily improving EBITM. The company aims to deepen engagement with top clients & secure new deals to drive qualitative growth. Given the early but promising signs of this turnaround, we expect strong operational performance ahead. Consequently, we revise our estimates upward by 0–3% and maintain our BUY rating with a revised target price of INR 1,931. This reflects a 24x (maintained) PE multiple based on the average of FY27E and FY28E EPS of INR 80.4.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131