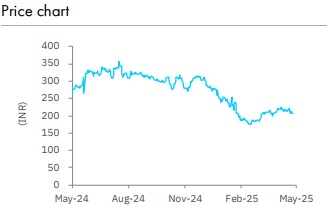

Buy NCC Ltd for Target Rs.278 by Elara Capitals

Strong inflows aid in visibility amid uncertainty

NCC (NJCC IN) FY25 standalone operational performance was in line with mid-year revised revenue guidance of 5% with margins at 9.25%; however, inflows surprised on the positive to the highest-ever at INR 295bn, up 8% YoY. Amid an uncertain economic environment, management is conservative, targeting order inflows to moderate to INR 220-225bn for FY26, with revenue growth of 10%, EBITDA margin of ~9.0-9.3% and capex of INR 7.5bn, due to requirement of a tunnel-boring machine (TBM) machine. We retain our positive stance, given robust orderbook, strong order prospects pipeline of INR 2.5tn and diversified sector presence which places the company in a sweet spot. We reiterate Buy with a TP of INR 278 on 15x FY27E P/E. We expect an CAGR earnings of 18% during FY25-28E

Better than estimated performance: Q4 revenue grew 15% QoQ and flat YoY to INR 54bn, 9% higher than our estimates, led by the pickup in execution post previous quarters’ delay in payments of the Jal Jeevan Mission projects Improvement in collections also aided reduction in standalone debt in Q4 by INR 9bn to INR 15bn. EBITDA margin was flat at 9.2% and PAT adjusted for exception loss of INR 386mn (provision for impairment in the Oman subsidiary) stood at INR 2.5bn, up 4% YoY, aided by high other income and partially offset by high finance expense on account of interest bearing advances at a high cost of ~12%.

Robust pipeline; inflow guidance conservative: Strong inflows at INR 160bn in Q4, 2.6x YoY, led by the buildings and transportation sector, lead to a healthy orderbook of INR 625bn providing book-to-bill visibility of 3.3x. For FY26 prospects, new order pipeline is healthy at INR 2.5tn and L1 position on orders worth INR 70-80bn, which is targeted to achieve inflows of INR 220-250bn (~10% conversion). Andhra Pradesh capital city development projects worth INR 95bn were received in Q4, with increased focus by the government toward infrastructure projects which are expected to pick up in the near term. Maharashtra government’s slow-moving projects have picked up and are likely to ramp up gradually

Retain Buy with a TP of INR 278: Amid an uncertain business environment, increased competition, and unforeseen delay, management expects inflows to moderate in FY26. Cashflow could take a hit in the interim due to capex of INR 7.5bn (INR 3.0bn for the TBM for the Mumbai project & INR 1.3bn for the smart meter project), and requirement of working capital loans for mobilization activity. However, we retain our positive stance, given robust orderbook, strong order prospects pipeline of INR 2.5tn and diversified sector presence. We reiterate Buy with a TP of INR 278bn on 15x FY27E P/E. We marginally tweak FY26 earnings estimates lower by 6.6%. We introduce FY28 estimates and expect a revenue CAGR of 12% during FY25-28E with an adjusted earnings CAGR of 18%. Key risks are delays in new project awarding, execution and collections.

Please refer disclaimer at Report

SEBI Registration number is INH000000933