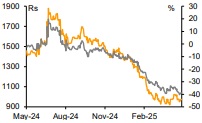

Buy Route Mobile Ltd Target Rs. 1,250 By Emkay Global Financial Services Ltd

Modest quarter; cross-sell synergies to aid margins

Route’s Q4FY25 operating performance was weak, albeit a tad better than our expectations. Revenue declined 0.7% QoQ, slightly above our estimate. Billable transactions grew 1% QoQ led by ramp up in domestic SMS volumes, while ILD and RoW SMS volumes and other transactions declined. EBITDAM contracted by 90bps QoQ due to a dip in gross margin by 180bps—due to higher volumes from related party transactions (RPT)—and partly offset by cost efficiencies. The management has refrained from providing specific revenue growth or margin guidance for FY26, considering the macro uncertainty and OTT shift, though it intends to gain market share and outperform industry growth rates over the medium term. The management indicated that margin has bottomed out in Q4; however, RPT revenue share trend and its implication on margins need to be observed in coming quarters. We trim FY26-27E EPS by 1-2%, factoring in the Q4 performance. We retain BUY with TP of Rs1,250 at 18x Mar-27E EPS, considering undemanding valuation (cash as a % of market cap is ~15%; double-digit growth profile business with ~6% FCF yield).

Results Summary

Revenue declined 0.7% QoQ and increased 15.5% YoY to Rs11.7bn, a tad better than our estimate. Number of billable transactions grew 1% to 39.3bn in Q4, from 38.9bn in Q3, while realizations declined 1.8% QoQ to ~30paisa. New product revenue grew 2%/29% QoQ/YoY to Rs832mn. Gross margin declined by 180bps QoQ to 19.3% in Q4 mainly due to higher contribution from RPT revenue (~14% of revenue in Q4). EBITDAM fell by 90bps to 10.4% due to a dip in GPM, partly offset by lower employee costs and other expenses. Reported profit was Rs566mn, and came below our expectations due to an exceptional loss of Rs247mn pertaining to impairment loss of goodwill and receivable write-off from an MNO. Net revenue retention stood at 107% for FY25, with recurring revenue at 90% over the same period. It has declared final dividend of Rs2/sh. What we liked: Healthy cash generation (OCF/EBITDA of 114% in FY25). What we did not like: Gross margin weakness.

Earnings Call KTAs

1) CPaaS industry is facing headwinds due to trust concerns around artificially generated traffic, prompting enterprises and OTTs to explore alternate communication technologies and reconsider their GTM strategy. 2) ILD (contributing ~2/3rd of India revenue) volumes faced challenges in Q4 due to a global technology company phasing out one of its core platforms and moving to alternate channels. 3) Telesign contributed ~14% of revenue in Q4, and RPT transactions were at lower margins. 4) Meta's pricing and incentive adjustments affected WhatsApp business messaging margins. 5) Operating costs increased in FY25 due to integration with Proximus, including investments in systems, processes, and competitive compensation to retain talent. It is implementing targeted efficiency measures, including AI-led automation to drive cost optimization. 6) Gross margin is expected to improve, with cross-sell synergies playing out in coming quarters.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354