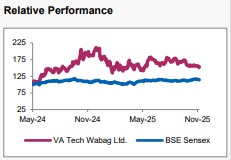

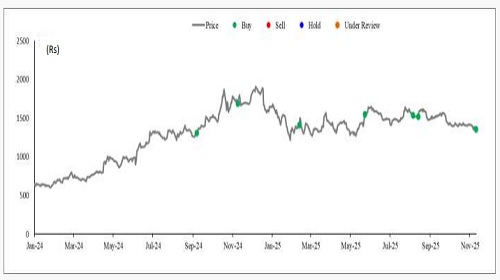

Buy VA Tech Wabag Ltd For Target Rs. 1,930 - Axis Securities Ltd

Robust Orderbook Reassures Long-Term Growth; Maintain BUY

Est. Vs. Actual for Q2FY26: Revenue - INLINE; EBITDA - MISS; PAT - BEAT

Change in Estimates Post Q2FY26

FY26E/FY27E: Revenue: -2%/1%; EBITDA: -5%/-5%; PAT: 2%/-2%.

Recommendation Rationale

* Robust Execution and Order Pipeline to Fuel H2FY26 Growth: Wabag delivered a 19% YoY growth in revenue for Q2FY26, broadly meeting our estimates. Revenue recognition is typically skewed towards the second half of the year, indicating strong H2. The management mentioned that margins may vary on a quarterly basis, while the medium-term margin outlook remains intact.

* Healthy Order Wins Underpin Growth Prospects: During H1FY26, the company secured fresh order inflows of ~Rs 3,477 Cr, ending the quarter with a diversified order book of ~Rs 16,020 Cr (including framework agreements), translating to over 4x its annual revenue. Additionally, it is the preferred bidder for orders worth over Rs 3,000 Cr, which are expected to materialise in the coming months.

* Entering the Sunrise Sectors: Notable wins during the quarter include a CBG production project under the BOT model in Uttar Pradesh and UPW, ETP & ZLD orders for Renewsys Solar’s Hyderabad facility, marking a strategic foray into the Future Energy Solutions vertical. These new sectors hold a high growth potential and can open up a whole new set of opportunities for the company..

Sector Outlook: Optimistic

Company Outlook & Guidance: Management highlighted that with a healthy order pipeline, strong balance sheet, and consistent execution capabilities, Wabag remains well-positioned to sustain its growth trajectory in line with its medium-term targets. The company intends to maintain an order book roughly three times its annual revenue, supported by an expected 15–20% revenue CAGR over the next 3–5 years, and EBITDA margins guided in the range of 13–15%.

Current Valuation: 21x Sep’27E (Earlier Valuation: 21x FY27E)

Current TP: Rs 1,930/share (Earlier TP: Rs 1,920/share)

Recommendation: We maintain our BUY rating on the stock.

Financial Performance: Consolidated revenues rose 19% YoY and 14% QoQ to Rs 835 Cr, in line with our expectations. EBITDA came in at Rs 89 Cr, down 5% YoY and 7% QoQ, below our estimates by 16%, with margins at 10.7% compared to 13.4% in Q2FY25 and 13% in Q1FY26. PAT stood at Rs 85 Cr, up 21% YoY and 29% QoQ, beating our estimate of Rs 75 Cr, supported by higher than expected other Income. Order intake for H1FY26 was Rs 3,477 Cr, taking the order book to Rs 16,020 Cr (including Framework contracts). Net Cash Position excluding HAM Projects stood at Rs 675 Cr.3

Outlook: We maintain a positive outlook on the company’s long-term prospects, supported by sustained sectoral tailwinds and Wabag’s strong positioning to capitalise on these opportunities. The company is focusing on revenue quality by selecting projects with low payment risk and healthy profitability, while working to enhance its revenue mix and reduce working capital requirements. Its foray into the so-called “Future Energy Solutions” can further boost the growth prospects of the company if successfully implemented.

Valuation & Recommendation: Wabag’s closing order book stood at ~Rs 16,020 Cr at the end of Q2FY26. We have rolled forward our estimates to FY28 earnings, and our FY26E/FY27E estimates, revenue projections remain unchanged. We view the order book as robust, reinforcing our positive long-term outlook. We now value the stock at 21x Sep’27E earnings, with a target price of Rs 1,930/share, implying an upside of 42% from the CMP. Accordingly, we maintain our BUY rating on the stock.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633