Buy Data Patterns India Ltd for the Target Rs. 3,100 by Choice Broking Ltd

Business Overview:

DATAPATT is a leading indigenous defence electronics solutions provider, specializing in design, development, and manufacturing of mission-critical systems. With expertise across radars, electronic warfare, avionics, and space electronics, the company stands out as a vertically integrated player with strong in-house capabilities and long-term partnerships with DRDO, ISRO, and the armed forces.

What makes DATAPATT special in private defence player circle?

In our view, DATAPATT stands out among private defence players owing to its deep involvement in defence developmental programs. A significant share of its revenue comes from design and development contracts. Once a system is successfully developed and proven, it typically transitions into the production phase, creating a long tail of revenue visibility. This model positions DATAPATT not only as a development partner but also as a long-term production beneficiary, giving it a strong runway for sustainable growth.

What further differentiates DATAPATT is its use of highly sophisticated technologies. The company has established expertise in EW systems, radars, avionics, automatic test equipment (ATE) system and space electronics—domains where few Indian private players have demonstrated credible capabilities. This positions the company in a niche segment of the ecosystem, allowing it to command higher entry barriers and build long-term relationships with both, DRDO and the armed forces.

In addition, we anticipate DATAPATT benefits from being an end-to-end solutions provider, with in-house design, development and manufacturing capabilities. This vertical integration not only reduces reliance on external vendors but also enhances margin and controls cost.

In our opinion, DATAPATT represents a rare private sector story in Indian defence, combining high-tech expertise with strong participation in developmental programs. As India accelerates its indigenisation push and allocates higher spends to electronic warfare, avionics and radar systems, we expect the company to be a significant long-term beneficiary.

How DATAPATT’s profile strengthens its position in defence ecosystem?

In our view, one of the underappreciated strengths of DATAPATT is its robust financial profile, which allows it to consistently reinvest in R&D and scale up without stressing its balance sheet. It operates with minimal debt and consistently generates strong free cash flows, ensuring that future growth is not dependent on external capital. This strength is particularly critical in defence electronics, where long development cycles and heavy upfront investments often strain the balance sheet of smaller private peers.

We also expect the company’s superior margin profile — a result of its vertically-integrated model and focus on high-value electronics — gives it a greater resilience and flexibility. While most defence manufacturers operate at mid-teen EBITDA Margin, DATAPATT has historically delivered well above that, reflecting its niche positioning in complex systems rather than commoditised assembly work. In our opinion, this combination of financial discipline and profitability creates a virtuous cycle, where strong cash flows fund further R&D, which, in turn, strengthens its technological edge and long-term order pipeline.

Valuation:

At present, we have a “BUY” rating on the stock with a Target Price of INR 3,100.

Key Risks:

1) High dependency on government contracts – Any possible delay in order placements or budget allocation could impact revenue flow, 2) Project execution risk – Long development cycles in defence electronics carry risks of cost/time overruns, 3) Customer concentration – Bulk of revenues tied to DRDO, ISRO and defence PSUs, limiting diversification.

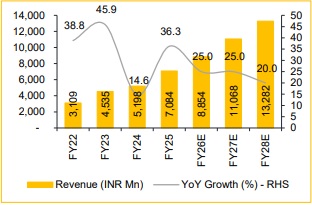

Revenue expected to expand 23.3% CAGR over FY25-28E

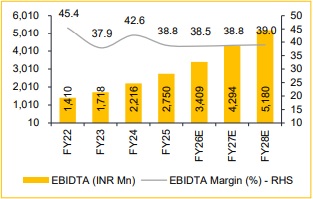

EBITDA Margin to improve led by better mix

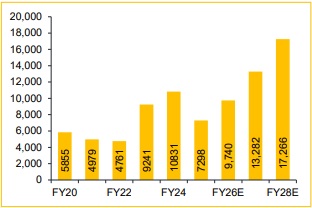

Order book position (INR Mn)

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131