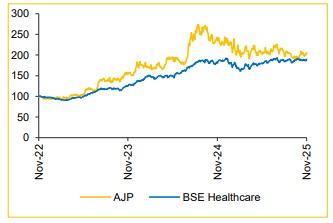

Reduce Ajanta Pharma Ltd for Target Rs. 2,510 by Choice Institutional Equities

Operational Stability, but Acceleration Drivers still Limited

We had a brief discussion with the management of AJP – Mr. Rajeev Agarwal (VP–Finance) to assess the near-term business outlook across India, US and Emerging Markets. India is likely to continue outperforming IPM and the US revenue is expected to stabilise at INR 3,200–3,250 Mn per quarter. Emerging markets should see mid-teens growth on a blended medium-term basis, though YoY may see volatility. Management reiterated its expectation of delivering low-teens revenue growth in FY26, with mid-teens growth over the medium term, while margin is expected to remain broadly stable with 50–100 bps YoY improvement.

View and Valuation:

Given this backdrop, we revise our earnings estimate up by 1.1%/2.1% for FY26/27E. While margin expansion is guided, it may be partly offset by continued field-force additions linked to pipeline launches. Hence, we maintain a conservative stance and factor in 50 bps margin improvement in FY27E. We retain our REDUCE rating with a revised TP of INR 2,510 (from INR 2,450).

Key Takeaways from the Meeting

India Business:

* India expected to grow 200–300 bps faster than IPM, supported by volume-led growth and 20–25 annual product launches.

* Growth drivers: 50% volume, 25% new launches and 25% price increase.

* New therapies: Gynac showing good traction and expected to deliver double-digit growth from next year; Nephro slower due to hospitaldriven dynamics.

* India MR expansion largely complete; Q3 becomes the new cost base.

US Generics:

* US quarterly revenues expected to stabilise at INR 3,200–3,250 Mn.

* 6–8% annual price erosion expected to continue; growth to be driven mainly by new launches.

* FY26 H1 saw 3 launches; possibly one more expected to launch this year (pending approval).

* Company prepared for day-1 entry into Semaglutide generics with tie-ups in place.

Emerging Markets (Asia + Africa):

* Emerging markets expected to deliver mid-teens growth over the medium term, with YoY volatility due to shipment timing and market dynamics.

* Africa Branded guidance revised upward to high single-digit / low double-digit growth for FY26.

* EM growth driven by 25–30 launches annually and market share gains; limited pricing power.

* Field force to expand 6–8% annually, from the current ~2,000 heads.

Institutional Business:

* Highly volatile; initial expectation of 50–60% decline narrowed to 5– 10% for FY26 as US funding now revived.

* Contribution expected to fall to ~2% of revenues next year as other regions continue to grow.

Margins & Financials:

* Margin guidance: 27% EBITDA in FY26, with 50–100 bps YoY improvement for the next two years driven by mix and operating leverage.

* Tax rate to rise 100–150 bps from FY27

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131