Buy Balrampur Chini Mills Ltd For Target Rs. 645 By JM Financial Services Ltd

Balrampur Chini’s 2QFY26 EBITDA was slightly above our estimates on account of robust sugar volumes and realisation. Sugar export of 1.5MMT allowed by the government is likely to be positive for domestic sugar realisation. Going ahead, we expect sugar volume and realisation to remain robust for Balrampur. On the distillery front, ethanol volume is likely to see some improvement with the company guiding for 280mn litres for ESY26. However, distillery profitability is expected to remain muted on account of lack of price revision. The PLA facility is set to be commissioned by 3QFY27 with optimal utilisation expected by Mar’27. Hence, we expect healthy contribution to the top line from PLA from FY27. Factoring in subdued distillery margins, we revise downwards our FY26-28 EBITDA and EPS estimates by ~3-5%. We roll forward to Dec’27E earnings and maintain BUY rating on the name with a revised SoTP-based Dec’26 TP of INR 645/share (from Sep’26 TP of INR 675/share earlier).

* 2QFY26 EBITDA slightly above our expectation: Balrampur Chini’s 2QFY26 gross profit came in 3% above JMFe at ~INR 3.2bn (down 1% QoQ while up 42% YoY) as revenue came in 9% above JMFe at ~INR 16.7bn (up 8%/29% QoQ/YoY) while gross margin came in lower than expected at 18.9% (vs. JMFe of 20% and 17.1% in 2QFY25). Other expenses were higher at ~INR 959mn (vs. JMFe of ~INR 950mn and ~INR 796mn in 2QFY25). As a result, EBITDA came in 3% above JMFe and stood at ~INR 1.2bn (down 10% QoQ while up 145% YoY). EBITDA margin came in lower at 7.2% (vs. JMFe of 7.6% and 3.8% in 2QFY25). Further, PAT came in 37% above JMFe and stood at INR 460mn (up 7% QoQ and from a loss of 35mn in 2QFY25).

* Sugar/distillery EBIT 8%/16% above/below our estimates: During the quarter, sugar sales volume came in at 303.4KT (vs. JMFe of ~266.5KT, up 15% YoY). Sugar realisation stood at INR 40.5/kg (vs. JMFe of INR 40/kg and INR 38.5/kg in 2QFY25). Sugar EBIT came in 8% above JMFe and stood at ~INR 528mn (up 10%/3315% QoQ/YoY). Sugar EBIT margin came in higher than expected at 4% (vs. JMFe of 3.5% and 0.1% in 2QFY25). During the quarter, distillery sales volume stood at 58.9KL (vs. JMFe of 75KL, up 29% YoY). Distillery realisation stood at INR 61.3/litre (vs. JMFe of INR 58.6/litre and INR 54.6/litre in 2QFY25). Distillery EBIT came in 16% below JMFe and stood at ~INR 594mn (down 24% QoQ while up 80% YoY). Distillery EBIT margin was lower than expected at 14.7% (vs. JMFe of 16% and 12.5% in 2QFY25).

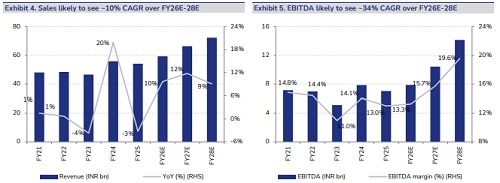

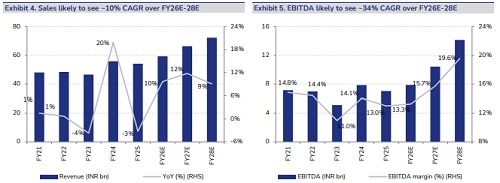

* EPS estimates revised downwards by ~4-5%; maintain BUY: The company has indicated that it is on track to commission the PLA project by 3QFY27and has spent ~INR 10.93bn (INR 5.7bn through debt and rest from internal accruals) on the PLA project as of 31st Oct'25. Going ahead, we expect sugar prices and volume to remain robust for the company. We are building in some improvement in ethanol volume as the company has guided for 280mn litres for ESY26. However, we expect the distillery margin to remain muted on account of the lack of price revision in ethanol, leading to subdued distillery profitability. Factoring in this, we have revised downwards our FY26-28 EBITDA and EPS estimates by ~3-4% and ~4-5%, respectively. We now expect 10%/34%/46% sales/EBITDA/EPS CAGR over FY26E-28E. We roll forward to Dec’27 earnings and maintain BUY with a revised SoTP-based Dec'26 TP of INR 645/share (from Sep’26 TP of INR 675 earlier).

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361

.jpg)