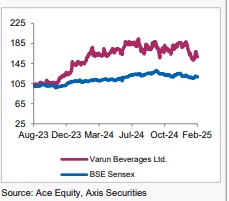

Buy Varun Beverages Ltd For the Target Rs. 710 By the Axis Securites

Recommendation Rationale

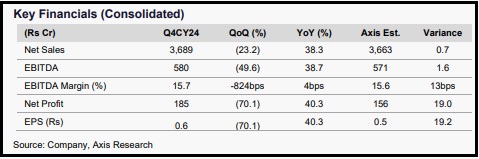

Volume-led growth: In Q4CY24, the company delivered a strong performance, driven by a 38.1% YoY increase in volume growth (~23.2% for CY24), fueled by expanded international operations. This included 43 million cases from South Africa and 7.8 million cases from the DRC. Realisation for CY24 rose by 1.3% to Rs 177.9 per case, led by a better product mix. In India, organic volume growth for CY24 was 11.4%, while international markets saw growth of 6.3%. However, the transition to a zero-sugar portfolio in Zimbabwe impacted growth due to the introduction of a sugar tax. The management remains optimistic, forecasting continued double-digit growth moving forward.

Margin performance: EBITDA margins remained flat at 15.7% in Q4CY24, despite a 56 bps YoY contraction in gross margins. However, gross margins for CY24 rose by 290 bps to 55.5%, mainly due to strategic procurement and storage of PET chips for price advantages, efforts to lower sugar content, and the growing benefits of backward integration. The share of low-sugar and no-sugar products grew to 53% of total sales volume. The company experienced a 100bps improvement in EBITDA margins for CY24, driven by gains in gross margins. This improvement was achieved despite the consolidation of South Africa’s operations, characterised by lower margins due to a high proportion of own brands (~80%) and the fixed costs tied to new capital expenditures not yet fully utilised.

Raised funds through QIP: The company successfully raised Rs 7,500 Cr through a Qualified Institutional Placement (QIP) in Q4CY24, which is utilised for debt repayment and acquisitions.

Sector Outlook: Positive

Company Outlook & Guidance: We expect VBL to continue its strong growth momentum in the mid- to long-term. Hence, we maintain our BUY recommendation on the stock.

Current Valuation: 48xDec-26EPS (Earlier: 52xSep-26EPS)

Current TP: Rs 710/share (Earlier TP: Rs 700/ share)

Recommendation: With an 30% upside potential from the CMP, we maintain our BUY rating on the stock.

Recommendation: With an 30% upside potential from the CMP, we maintain our BUY rating on the stock.

Distribution Expansion VBL reaches 4 Mn FMCG outlets out of 12 Mn outlets, presenting significant opportunities. The company plans to expand to 8-10 Mn outlets over time, adding 10-12% new outlets annually. This expansion fuels growth, with India's untapped market offering substantial potential.

New launches The company plans to introduce a new flavor to its energy drink line, Sting Gold, and hopes to launch it soon. Additionally, other products are in development and expected to be ready before the upcoming season. Sting Gold is positioned as a long-term addition to the product portfolio.

Outlook VBL is expected to maintain its strong growth momentum driven by several key factors: 1) The successful strategic acquisition of the BevCo, which consolidates its presence in South Africa and DRC; 2) Expansion of its snacks portfolio outside India, particularly in Zimbabwe and Zambia; 3) Continued focus on increasing distribution reach, especially in rural areas; 4) The commissioning of multiple greenfield and brownfield facilities, enhancing manufacturing capabilities and market reach while reducing transportation costs; and 5) Expansion of the high-margin Sting energy drink, along with increased emphasis on value-added dairy, sports drinks (Gatorade), and juice segments. These investments are expected to support the company’s long-term growth and profitability.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633