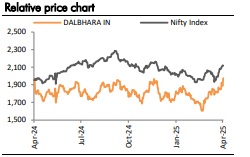

Add Dalmia Bharat Ltd For Target Rs.2,161 By Equirus Securities

Realisation gains awaited; lower costs aid profitability – maintain ADD

* Dalmia Bharat’s (DALBHARA) 4QFY25 volumes declined 2% yoy to 8.6MT (+29% qoq, in line with EE), reflecting the impact of JP tolling volumes discontinued earlier in Oct’24 amid uncertainties surrounding Jaypee's insolvency proceedings.

* Realisations remained under pressure with no price improvements (-3% yoy/flat qoq) seen in the southern market during 4QFY25. Overall EBITDA/t increased Rs 179 yoy/ Rs 157 qoq to Rs 922 (EE: Rs 936) on lower P&F and other expenses.

* We broadly maintain our FY26/FY27 EBITDA estimates. Recent price hikes in South India should support the company’s FY26 earnings, though sustainability of these hikes needs to be monitored. Volume-led market share competition in this region is set to intensify due to recent ownership changes of key assets.

* With meaningful near-term triggers elusive as of now, we maintain ADD on the stock with a Jun’26 TP of Rs 2,161 (vs. Rs 1,983 earlier) at 11x (unchanged). one-year forward EV/EBITDA.

In-line performance, industry demand visibility improves: Consolidated revenues fell 5% yoy but rose 29% qoq to Rs 40.9bn (3% below EE) on higher volumes sequentially, with a recovery in government spending and pent-up demand post festive season. Realisations however were muted as continued pressure in the southern market negated eastern market pricing benefits. Management expects higher industry growth of 7-8% in FY26E vs. 4-5% in FY25 on better infra demand and government spending. It also anticipates pricing in South India to improve, aided by market consolidation and a prolonged trough in prices over the past year. We maintain a ~9% volume CAGR for the company over FY25-FY28E.

Combined focus on growth & profitability: At FY25-beginning, DALBHARA had guided to Rs 150-200/t growth in EBITDA over the next two years. In 4Q, it has already witnessed an EBITDA recovery of Rs 179 yoy/Rs 157 qoq per tonne to Rs 922/t on better operating leverage, a higher renewable energy share (39% vs 34% yoy), improving heat and power consumption rates, and logistics cost optimisation. It aims to take its renewable capacity to 595MW by FY26E from 267MW at present.

Expansion phase-2 underway: DALBHARA, post commissioning 2.9MTPA in 4Q and attaining its 49.5MTPA target for FY25, has now guided for a capacity of 75MTPA by FY28E. As part of its phase-2 expansion plans, the company has further announced an expansion of 6.6MTPA in Belgaum (Karnataka) and Pune. It expects FY26 capex at Rs 35bn (FY25: Rs 26.6bn), and intends to keep its net debt/EBITDA ratio under 2x (0.3x at present) with gross debt of Rs 53bn vs Rs 46bn yoy. Risks: Tepid demand, continued pricing pressure, energy/fuel cost inflation, and an increase in leverage for reaching the desired expansion in capacity.

Above views are of the author and not of the website kindly read disclaimer