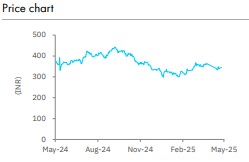

Buy NTPC Ltd for Target Rs. 462 by Elara Capitals

Capacity addition to ramp up

NTPC (NTPC IN) delivered a stable Q4FY25 with 3% YoY revenue growth to INR 439bn and 4% YoY PAT growth to INR 58bn, although adjusted PAT remains flat at INR 50bn. FY25 capacity addition stood at 3.97GW, including ~3.3GW for renewables. With 33.7GW under construction and targeted addition of 11.8GW in FY26 and 9.9GW in FY27, growth visibility remains strong. Standalone regulated equity rose 4% YoY to INR 909bn and consolidated at INR 1,087bn. Strategic moves, such as 8GW thermal approvals, a 20GW PSP pipeline, 30GW nuclear ambition support long-term growth. We retain Buy with a TP of INR 462.

Reported PAT up 4% YoY; adjusted PAT flat: NTPC reported revenue growth of 3% YoY to INR 439bn in Q4FY25. EBITDA reported a slight decline of 1% YoY to INR 112.5bn. Depreciation rose 8% YoY and interest cost increased 24% YoY. Other income was up 13% YoY to INR 19bn. Tax rose 10% YoY to INR 23bn. Reported PAT increased 4% YoY to INR 58bn. Adjusted PAT was flat at INR 50bn. Gross generation went up 2% YoY to 95.23BU in Q4FY25. The plant load factor was at ~81.2% in Q4FY25.

Healthy project pipeline: The company currently has 33.7GW of projects spanning across thermal, hydro and renewable under construction. It has 16.9GW of thermal, 2.2GW of hydro and 14.6GW of renewable projects under construction. It anticipates a capacity addition of 11.8GW at the group level in FY26, which comprises 3.6GW of thermal, 1GW of hydro and 7.2GW of renewable projects. It expects a capacity addition of 9.9GW at the group level in FY27, comprising 4.14GW of thermal, 444MW of hydro and 8GW of renewables.

Standalone regulated equity rises 4% YoY; consolidated up 4%: NTPC added ~3.9GW of capacity in FY25. Renewable capacity of ~3.3GW was added in FY25. As on FY25, the commercial capacity was 59,413MW on a standalone basis and 79,930MW for the NTPC Group. Regulated equity at the standalone level was INR 909bn, up 4% YoY, and regulated equity on a consolidated basis was INR 1,087bn, up 4% YoY. It has received new investment approval for thermal projects of 8GW worth INR 1tn. It has a pipeline of 20GW for pumped storage projects and has set an ambitious target of 30GW for nuclear projects.

Retain Buy with a TP of INR 462: The company is a play on energy transition as well as energy security. We believe its regulated equity base will increase on addition of thermal capacity. An expanding RE pipeline and foray into new business verticals of green hydrogen pumped hydro storage and nuclear should drive growth. The stock is trading at 1.8x FY27E P/B, which is attractive. We retain Buy with a TP of INR 462 on better visibility on regulated returns and traction in RE initiatives based on 2.5x FY27E P/B regulated equity, and 1.0x (unchanged) in cash and investment. We introduce FY28E earnings.

Please refer disclaimer at Report

SEBI Registration number is INH000000933