Daily Derivatives Report 31th December 2025 by Axis Securities Ltd

The Day That Was:

Nifty Futures: 26,118.8 (0.0%), Bank Nifty Jan Futures: 59,586.2 (0.4%).

Nifty Futures ended marginally lower yesterday, as the absence of fresh domestic triggers and pre-holiday caution and limited aggressive positioning. Traders engaged in significant rollover and position squaring ahead of the final derivatives expiry of 2025, which restricted major directional bets and underscored a prevailing neutral-to-cautious bias. Volatility characterized the session amid the Nifty monthly derivatives expiry, while a technology-led selloff on Wall Street overnight pressured domestic IT exporters and heightened risk-off sentiment. Nifty January Futures fell 2.5 points as open interest increased by 45.3% to 151.07 lakh shares, indicating a strategic short build-up. Bank Nifty January Futures showed relative resilience, rising 243.8 points with an open interest increase of 32.0% to 12.47 lakh shares, signaling a localized long build-up. The Nifty futures premium expanded slightly to 180 points from 179 points, while the Bank Nifty premium rose to 415 points from 410 points, reflecting sustained cost-of-carry despite the flat underlying price action. Sectorally, Nifty Metal and Nifty Auto emerged as top gainers due to rising commodity realizations and robust IIP data, whereas Nifty IT and Nifty FMCG lagged following Nasdaq weakness and profit-booking in defensives, highlighting a clear shift toward cyclical outperformance. The India VIX closed at 9.68, a decrease of 0.44% after a prior 6.22% spike, suggesting that the recent correction is finding a technical base. The rupee rose 23 paise to close at 89.75 against the greenback, supported by the RBI’s proactive liquidity management and dollar swaps, which mitigated year-end currency volatility and provided a stable macroeconomic backdrop for equity markets.

Global Movers:

Wall Street faced a late-December chill as the "Santa Claus" rally stalled amid aggressive year-end profit-taking. The Nasdaq shed 0.24% to close at 23,419, while the S&P 500 retreated 0.2% to 6,896. The Dow fell 0.51% (95 points) to 48,367, ending its streak of record highs as investors locked in gains from the 2025 AI-driven surge. Fixed income saw the 10-year yield soften to 4.13%, reflecting a slight flight to safety as equity momentum cooled. Treasury prices are poised to remain stable as traders avoid major directional bets ahead of the New Year. Commodities saw a significant reversal; Gold spot was flat at $4,338 and Silver $75, retreating from overbought levels. Conversely, WTI Crude edged up 0.33% to $57.80 on renewed supply-side geopolitical risks. Precious metals are expected to consolidate further near psychological support, while oil prices remain tethered to inventory data.

Stock Futures:

Steel Authority of India Ltd (SAIL) surged 5.1% as sectoral momentum lifted the counter, aided by policy signals targeting 300 MT steel capacity by 2030 and robust industrial output at 6.7%. Futures open interest rose 7.4% to 43,281 contracts, with 2,975 additions, while December series OI climbed 6.49 Cr to 20.34 Cr and rollover hit 97.9% versus 90.4%. Expiry-to-expiry, the stock advanced from Rs 132.8 to Rs 142.05, up 6.6%. Derivatives positioning reflects aggressive long build-up, with call buyers pressing advantage and put writers retaining control, signaling sustained bullish conviction.

National Aluminium Co Ltd (NATIONALUM) vaulted 4.4% to a 52-week high, tracking MCX aluminium’s 4.44% jump and LME-led supply concerns. Futures OI fell 11% to 14,263 contracts, shedding 1,759, while December series unwound 1.44 Cr to 5.34 Cr and rollover eased to 87.4% from 93.3%. Expiry-to-expiry, the stock leapt from Rs 255.7 to Rs 316.4, a 24.7% gain. The sharp short covering underscores capitulation by bears, with call writers squeezed and put buyers retreating, reinforcing a momentum-driven bullish stance.

Mazagon Dock Shipbuilders Ltd (MAZDOCK) slipped 2.6% as profit-booking weighed amid F&O expiry. Futures OI rose 4.2% to 29,243 contracts, adding 1,177, while December series OI expanded 13.34 Lc to 51.18 Lc and rollover stood at 95.3% versus 93.7%. Expiry-to-expiry, the stock fell from Rs 2,657.7 to Rs 2,482.1, down 6.8%. The short addition highlights fresh bearish bets, with put buyers gaining traction and call writers consolidating, pointing to continued downside risk.

Indian Railway Catering and Tourism Corp Ltd (IRCTC) declined 2.2% as unwinding followed news of its planned F&O exit in February 2026. Futures OI slipped 1.5% to 22,432 contracts, shedding 350, while December series OI added 4.91 Lc to 1.96 Cr and rollover rose to 96.6% from 93.4%. Expiry-to-expiry, the stock edged up from Rs 681 to Rs 686.55, a 0.7% gain. Long unwinding signals weakening conviction, with call buyers retreating and put writers firming, suggesting cautious sentiment ahead of regulatory transition.

Put-Call Ratio Snapshot:

The Nifty put-call ratio (PCR) fell to 0.92 from 0.93 points, while the Bank Nifty PCR rose from 1.03 to 1.06 points.

Implied Volatility (IV):

DIXON TECHNOLOGIES closed at 11,767.00 (-0.8%) with a 30d IV of 42.1 and a high IVR of 74.9. This elevated IVR favors a delta-neutral stance to capture premium decay, as price action is expected to transition into a moderate range-bound phase. HINDUSTAN UNILEVER settled at 2,290.20 (-0.1%) with 30d IV at 16.9 and an IVR of 64.2. Current moderate-to-high IVR levels suggest a buying advantage for anticipatory pricing, signaling an expected shift from narrow consolidation toward a wider price range expansion. GAIL INDIA LTD ended at 170.6 (+0.1%) with a 30d IV of 19.4. These bottom-percentile volatility levels dictate a wait-and-watch stance, with the expectation that the stock will maintain its current narrow sideways consolidation. ADANI PORTS finished at 1,461.20 (+0.5%) with 30d IV at 20.2. Given the negligible volatility relative to its yearly range in both the stocks, the mathematical edge remains flat, warranting a wait-and-watch approach during this continued period of sideways price action.

Options volume and Open Interest highlights:

Heromotoco and PNB Housing are displaying short-term bullish momentum, supported by highly concentrated Call-to-Put Volume Ratios of 3:1 and 4:1, respectively. This reflects a strong preference for Call option buying. At the same time, such an extreme skew toward Calls can be interpreted as a contrarian signal, suggesting that the current upward price move may be approaching an immediate peak, as buying interest could soon be exhausted or profit-booking may set in. PolicyBzr and ABB, on the other hand, are facing pressure from increasing bearish expectations. This is evident in the rising Put option volumes along with a significant build-up of Open Interest at lower strike prices, which is acting as a cap on further price appreciation. Even with this bearish OI accumulation, their overall volume ratios remain neutral, indicating a limited but possible chance of a counter-trend reversal if selling pressure subsides. From an options positioning perspective, RVNL and VEDL appear to be in a pronounced consolidation phase, setting the stage for a rapid directional breakout. Both stocks show heavy accumulation of Call Open Interest near their 52-week highs. In parallel, Concor Ltd and Hudco Ltd are witnessing similar saturation on the Put side. This strong concentration of Open Interest on both sides of the options chain suggests that a sharp and sudden price move is building up, likely to be triggered once these heavily positioned option contracts are unwound. (This data covers only stock options with at least 500 contracts traded on the day for both calls and puts).

Participant-wise Open Interest Net Activity:

Index Futures witnessed a 21,163-contract shift as retail and institutional sentiment diverged sharply. Clients and FIIs spearheaded the bullish expansion, mounting 10,285 and 10,878 fresh contracts, respectively. This aggressive accumulation stood in stark contrast to the heavy liquidation from Proprietary traders, who shed 14,389 contracts, while DIIs pared their exposure by 6,774. The Stock Futures segment mirrored this institutional dominance amid a massive 102,096-contract turnover. FIIs exhibited a robust risk-on bias, injecting 81,440 contracts, bolstered by a 20,656-contract uptick from Proprietary desks. Conversely, Clients aggressively unwound 60,138 positions, joined by DIIs who trimmed 41,958 contracts. The data highlights a significant rotation of risk, where institutional conviction—led by foreign inflows—effectively absorbed the massive retail exodus and domestic profit-taking.

Securities in Ban for Trade Date 31-December-2025: NIL

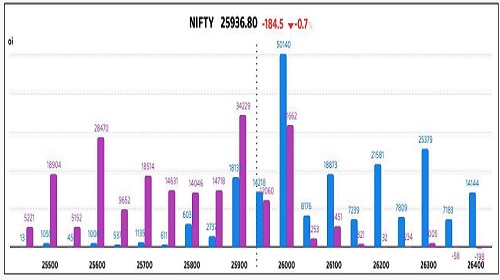

Nifty

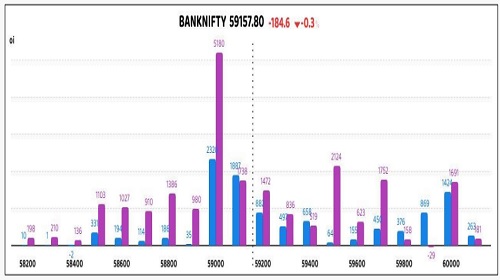

Banknifty

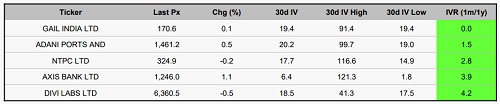

Stocks with High IVR:

Stocks with Low IVR:

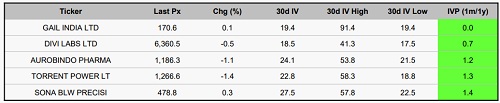

Stocks With High IVP:

Stocks With Low IVP:

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633