Accumulate Aavas Financiers Ltd for the Target Rs. 1,900 By Prabhudas Liladhar Capital Ltd

Sustained disbursal run-rate a key

Quick Pointers:

* Good quarter as disbursals normalize cushioning NIM and other income.

* AuM/disbursals guided to grow at 20%; competition to be keenly watched.

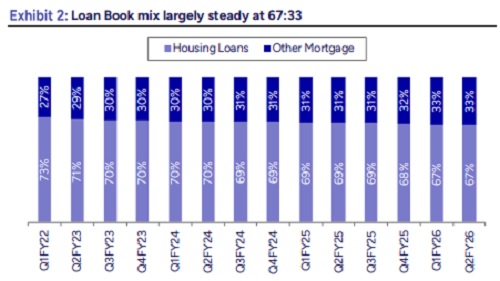

AAVAS saw a good quarter led by better margins, higher fees & assignment income and lower opex. Disbursal growth normalized as guided and company expects run-rate in H2FY26 to improve to Rs6.5-7.0bn per month (Rs5.0bn in last 5 months); we had factored this run-rate which would translate to 17% AuM growth for FY26. While company has guided to medium term growth of 20% per annum, its larger size and competition for bigger HFCs to scale up affordable housing, could hinder credit flow or pricing. While AAVAS saw funding cost benefits due to EBLR linked borrowings, we are factoring lower NIM for FY27 (vs FY26) as downward asset repricing may continue in FY27. We tweak multiple to 2.6x from 2.8x and our TP slightly reduces to Rs1,900 from Rs1,925 while we roll forward to Sep’27 ABV. Retain ‘ACCUMULATE’.

Beat on NII/PAT due to NIM/other income; slight blip in asset quality: NII was higher at Rs2.9bn (PLe Rs2.6bn) since NIM (calc.) was a beat at 6.6% (PLe 6.2%) as reported funding cost fell by 17bps QoQ to 7.85%. Reported spread improved by 13bps QoQ to 5.23%. AuM grew by 16.1% YoY (PLe 15%); disbursals were in-line at Rs15.6bn (PLe Rs15.5bn); while repayments were lower at Rs6.2bn (PLe Rs8.2bn). Other income was higher at Rs1038mn (PLe Rs963mn) due to higher assignment income. Opex at Rs1.7bn was 4.9% below PLe due to lower employee cost. Thus, PPoP came in at Rs2.2bn which was 22.3% above PLe led by higher NII/fees and lower opex. On asset quality, gross stage-3 at 1.24% saw a slight blip QoQ (PLe 1.16%); PCR was 31.45% (PLe 31.03%). Provisions were in-line at Rs79.6mn (PLe Rs81mn). PAT was 22.8% above PLe at Rs1.6bn.

Disbursals normalize; NIM benefit due to lower CoF: Monthly disbursal run-rate in H2FY26 is guided to be Rs6.5-7.0bn (Rs5.0bn in last 5 months). Company expects 20% AuM growth over next 5 years with branch expansion to contribute 8%; growth of 7-8% would emanate from enhanced employee productivity and growth of 4-5% should be inflation led. Fall in repo benefitted the funding cost, incremental loan rate is 25bps lower than stock which led to fall in blended loan yields; incremental borrowing has seen a benefit of 60bps compared to last year. Repricing benefit on MCLR book has not flown thru completely. Company has shifted large part of its borrowing to EBLR and short tenure MCLR structures in anticipation of potential softening of interest rates. Company expects to reassess its PLR once the book is fully repriced.

Asset quality was a slight drag: For H1FY26 gross bounce rate stood at 18% and net bounce rate at 13.5%. Karnataka saw MFI related disruption after passing of ordinance and company proactively tightened the underwriting, slowing down disbursal and strengthening field verification. Eastern MP is seeing some stress; AAVAS has tightened underwriting and implemented sharper credit & income assessment standards. As per management, less than 1.8% of AuM was impacted by tariff related issues with pockets of stress seen in Karnataka, Gujarat and MP.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271