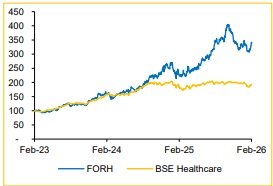

Buy Fortis Healthcare Ltd for the Target Rs.1,140 by Choice Institutional Equity Limited

Strong execution and continuous network expansion driving growth: FORH targets sustained double-digit growth driven by ~430 bed additions in FY27, brownfield expansion at high-occupancy hospitals and cluster-led acquisitions. Diagnostics will scale via network expansion (4,370+ touchpoints) and rising preventive (12%) and specialty (35%) mix, supporting continued margin expansion and earnings compounding.

View and valuation: FORH is progressing well with its cluster strategy, led by hospital margin expansion and diagnostics scale-up. We maintain our ‘BUY’ rating and with a target price to INR 1,140, based on an SoTP valuation (see Exhibit 2). We value the hospital business at 29x (maintained) EV/EBITDA on an average of FY27–28E, reflecting ARPOB growth and capacity additions. We also value the diagnostics segment at 25x (maintained) EV/EBITDA on average of FY27–28E, factoring in store expansion and margin improvement.

Revenue and EBITDA show strong YoY operational momentum

* Revenue grew 17.5% YoY but de-grew by 2.8% QoQ to INR 22.7 Bn (in-line with CIE estimate), driven by 14% increase in occupied beds

* ARPOB grew by 4.5% YoY to INR 70,137, with occupancy at 67%

* EBITDA rose 34.8% YoY / (9.1%) QoQ to INR 5.1 Bn; margin improved by 287bps YoY and (154bps) QoQ to 22.3% (vs. CIE estimate: 22.5%) ? APAT de-grew by 4.7% YoY/25.0% QoQ to INR 2.3Bn (vs. CIE estimate: INR 2.7 Bn), with a PAT margin of 8.6%

Hospital Business: Scalable capacity expansion driving sustainable growth and margin upside: FORH has added ~750 beds in FY26 and plans ~430 beds in FY27, primarily through high-return brownfield expansions such as the 200+ bed addition at FMRI (commissioning from April onward). Additional expansion at Shalimar Bagh, Faridabad (Onco block), Jaipur (oncology expansion over 18–24 months) and further ramp-up of Greater Noida and Manesar provide multi-year growth visibility. We believe that the current growth and margin trajectory to sustain for the next few years, supported by cluster-based acquisitions and strong demand in tertiary care, reinforcing earnings compounding potential.

Agilus Diagnostics: Network expansion and specialty mix to drive sustainable growth: The diagnostics segment of FORH is positioned for scalable growth through aggressive network expansion and higher-margin test mix. The company expanded to 4,370 customer touchpoints, with continued additions expected to drive volume growth and improve accessibility. Preventive diagnostics contribution increased to 12%, while specialized testing reached 35%, both expected to rise further, supporting higher realizations and profitability. We believe that network expansion, preventive healthcare adoption and specialty diagnostics scaling will enable sustained revenue growth and maintain structurally higher EBITDA margins over the medium term.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131