Buy Narayana Hrudayalaya Ltd For Target Rs.2,100 by Prabhudas Liladhar Capital Ltd

EBITDA beat aided by India operations

Quick Pointers:

* Bed expansion plan of 1,500 beds in India by FY29.

* Insurance losses across India and Cayman were reduced QoQ.

Narayana Hrudayalaya (NARH) reported strong EBITDA of Rs4.1bn (up 32% YoY) in Q2FY26, 8% above our estimates driven by robust performance across India and Cayman operations along with reduced losses in the insurance business. The Cayman business reported profitability of Rs1.56bn (up 58% YoY), adjusted for CIHL losses, up 61% YoY. India business reported healthy EBITDA adjusted for NHIC losses, up ~21% YoY. The management reiterated its aggressive capex plan and commitment towards growing throughput over the next 3-4 years through debottlenecking, refurbishment and better bed mix. In the medium term, NARH intends to add +1,500 beds expansion over next 3 years through greenfield and brownfield across Bengaluru, Kolkata and Raipur. Our FY27E and FY28E EBITDA stands increased by 15-17% as we factored in UK acquisition while PAT largely remain unchanged. We maintain ‘BUY’ rating with a TP of Rs2,100/share, based on 26x EV/EBITDA for India business and 15x EV/EBITDA for international operations based on Sept 2027E.

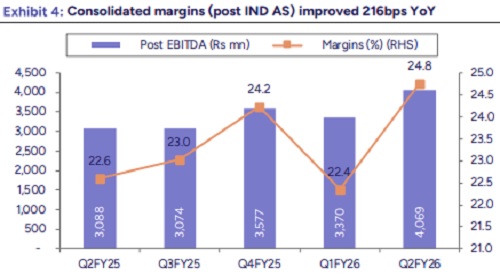

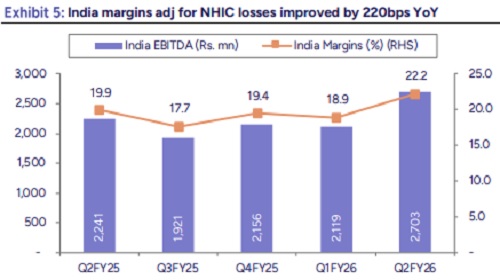

* EBITDA beat led by strong growth across India and Cayman business: NARH reported EBITDA of Rs4.1bn; up 32% YoY (21% QoQ); adjusted for NHIC & CIHL losses it was also up by 32% YoY (Rs 4.3bn). Q2 Losses in India insurance and clinics business were to the tune of Rs164mn (Rs 193mn in Q1) while losses from Cayman integrated healthcare (CIHL) were to tune of Rs 26mn (Rs 93mn in Q1). Overall, margins came in at 24.8%, increased 220bps YoY. India business adjusted for insurance and clinics, reported EBITDA of Rs2.7bn, up ~21% YoY. India margins improved by 230bps YoY and 336bps QoQ to 22.2%. Cayman EBITDA adj for CIHL came in at $18.3mn, up 53% YoY and flat QoQ, with OPM of ~43%.

* Higher ARPOB aided India growth: Revenues grew by 20% YoY to Rs16.4bn. ARPOB for India business grew 14% YoY to Rs47,945/day led by better payor mix and shift to high-end procedures (cardiac robotics, complex surgeries). IP volumes were down 7% YoY for India; impacted due to lower footfalls especially from Bangladesh and capacity constraints in existing hospitals. Cayman revenues increased 43% YoY to $41.6mn. Both IP and OP volumes improved by 50% and ~40% YoY, respectively, for Cayman aided by ramping up in new unit. Reported PAT stood at Rs2.64bn (up ~33% YoY). NARH’s net debt decreased by Rs. 964mn QoQ to Rs2.5bn.

Conference Call Highlights:

* Bed expansion plan – The 100-bed (lease) expansion at the Bangalore flagship is progressing as planned and is expected to be commissioned by Q1FY27. Overall, NARH has a total 1,535 bed expansion plan in Kolkata, Bengaluru and Raipur in the next 3-4 years; of which 60% is greenfield.

* Capex and its guidance: Management reiterated the Rs30bn India capex plan over three years, covering greenfield, brownfield, O&M and acquisitions. FY26 capex deployment continues, with some spending spilling over into early FY27, but the company remains on schedule on cost and timelines.

* Cayman – post-commissioning of 2nd unit, the hospital has seen a 50%+ increase in discharges and a large jump in OP/IP volumes. Mgmt guided for a few more quarters of growth remain before moderating to high single digits.

* Integrated Care (Cayman CIHL) - Insurance business has just about broken even in Q3. During Q2, CIHL reported revenues of Rs804mn with losses of Rs26mn. Insurance revenues have doubled QoQ, driven by significant employer adoption; market size is estimated at USD 300–350mn including government schemes. Cayman insurance business remains employersponsored only.

* India Hospitals units: Strong margin improvement across the network driven by improvement in case-mix, higher-end procedures, payer-mix optimization and throughput efficiencies; East India units have also seen sharp improvement. Despite minimal bed additions, India delivered ~20% EBITDA growth, supported by higher realization from niche and robotic procedures and intact occupancy.

* Mumbai unit: Mumbai unit continues to underperform; currently generating around low single-digit negative EBITDA, though October showed notable improvement. Mumbai unit guided for break-even in near term if recent traction from a pediatric-only model to adult + high pediatric focus sustains.

* Flagship Units (Bangalore & Kolkata): Flagships are seeing strong realization gains as patients shift to higher-configuration beds and niche work (including robotic cardiac surgeries) picks up; these units had positive impact on consolidated margins.

* Integrated care business (NHIC & NHIL): Integrated Care (clinics + India insurance) remains loss-making, though retail insurance subscribers continue to grow with losses in both clinics and the India insurance business continue to narrow, and management expects this positive trajectory to sustain.

* CGHS rate change impact: CGHS-linked tariffs account for ~60% of applicable contracts; the latest revision is expected to deliver ~30% package price uplift where applicable. Expect Rs400-500mn positive impact on revenues

* Practice Plus (UK Clinics) Acquisition: The UK clinics will continue operating under their existing brand, given the distinct operating model versus India/Cayman. Transaction costs (~5%) will be recorded in UK books. Integration will follow a collaborative learning approach rather than a direct India playbook rollout. Private-mix uplift initiatives are already in motion at the target, and NARH plans to accelerate this once post-acquisition stabilization is complete. In the UK, private patient mix is low at ~7–8%, offering substantial headroom compared with peers (30–75%).

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271