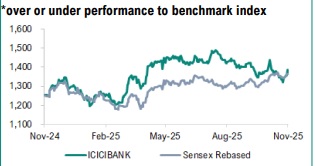

Buy ICICI Bank Ltd for the Target Rs.1,568 by Geojit Investments Ltd

Loan growth picks up; optimistic outlook

ICICI Bank has a pan-India footprint. It specializes in retail and corporate banking as well as foreign exchange (forex) and treasury operations. ICICI Bank also offers investment banking, insurance and financial services.

* ICICI Bank’s standalone interest income rose 3.0% YoY to Rs. 41,758cr in Q2FY26, primarily driven by a 10.3% YoY increase in total advances.

* Interest expenses fell 1.3% YoY to Rs. 20,228cr as the cost of deposits dropped to 4.64% (-20 bps YoY). Consequently, net interest income grew 7.4% YoY to Rs. 21,529cr.

* Net interest margin (NIM) expanded 3 bps YoY to 4.3%, influenced by lower deposit rates and cost of borrowing, combined with the beneficial effects of repricing external benchmark-linked loans and investments.

* Pre-provision operating profit (PPOP) soared 3.4% YoY to Rs. 17,298cr, fuelled by an increase in the total income (+3.4% YoY), offsetting the impact of elevated operating expenses (+17.3% YoY).

* Reported PAT rose 5.2% YoY to Rs. 12,359cr owing to decreased provisions and contingencies in Q2FY26 (-25.9% YoY, -49.6% QoQ). Provisions declined sequentially because of seasonal trends in the Kisan Credit Card (KCC) business and the overall healthy asset quality across segments.

Outlook & Valuation

ICICI Bank delivered a satisfactory performance in Q2FY26 supported by healthy loan growth and resilient margin, amid a competitive environment. The bank highlighted continued traction across retail and business banking segments. Asset quality was stable, with prudent provisioning and strong capital buffers ensuring balance-sheet resilience. Its strategic focus on risk-calibrated profitable growth positions the bank for long-term scalability. Stable asset quality, better unsecured cohort and smother regulatory transitions are expected to strengthen future performance. Hence, we upgrade our rating on stock from HOLD to BUY, based on sum-of-the-parts (SOTP) valuation, with a revised target price of Rs 1,568.

Key Highlights

* Loan growth has picked up, particularly in retail and business banking, as the bank’s advances grew 10.3% YoY to Rs. 1,408,456cr, with retail loans increasing 6.6% and the business banking book expanding 24.8%, while domestic corporate and other loans grew 3.5% YoY. However, rural loans decreased 1.3 YoY%.

* As of September 30, the bank’s total deposits increased 7.7% YoY to Rs. 1,612,825cr, supported by a 7.3% growth in term deposits, 6.2% in savings deposits and 12.9% in current deposits.

* The bank aims to leverage its distribution and platforms to expand its transaction banking business and deepen corporate relationships. This, along with synergies from ICICI Direct, is expected to drive sustained growth in CASA (current account and savings account) deposits.

* The bank expects its margin to remain stable or range-bound over the next two quarters and anticipates benefiting from further deposit repricing and the full impact of the Cash Reserve Ratio (CRR) cut in Q3FY26. However, this quarter may also see an increase in nonaccruals due to the KCC season, which could offset some of the positives.

* ICICI Bank aims to maintain a risk-adjusted PPOP growth path, where profitability and growth are synchronized rather than prioritizing one over the other, all within a sustainable framework.

For More Geojit Financial Services Ltd Disclaimer https://www.geojit.com/disclaimer

SEBI Registration Number: INH20000034