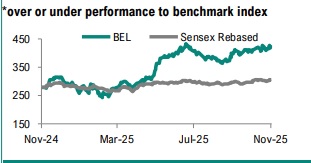

Buy Bharat Electronics Ltd for the Target Rs.504 by Geojit Investments Ltd

Robust execution...multi year growth visibility.

Bharat Electronics Ltd. (BEL) is a Navaratna enterprise with a 37% market share in Indian defence electronics. BEL’s core capabilities are in radar & weapons systems, defence communication & electronic warfare.

* BEL delivered robust revenue growth of 26% YoY in Q2FY26, driven by strong execution across key programs such as LRSAM, Himshakti, Akash Army, and LCA avionics. As a result, net profit rose 18% YoY, coming in ahead of expectations.

* EBITDA rose 22% YoY, while gross margin contracted 230 bps on account of higher material costs and product mix. However, operating efficiencies cushioned the impact, limiting margin erosion to 90 bps, at 29.4%.

* The current order backlog is Rs. 74,453cr (2.6x FY26E sales), provides a strong earnings visibility for the next 3 years.

* BEL’s EBITDA margin guidance of >27% appears achievable, supported by product mix, rising indigenous content and cost optimisation. We forecast earnings to grow at a 21% CAGR over FY25–27E.

Outlook & Valuation

BEL continues to deliver above expectations on revenue, margins, and execution front, reinforcing our positive view. A robust order backlog, strong inflow momentum (Rs.12,539cr till Oct), and visibility on large programs (QRSAM, NGC, LCA avionics, GBMES) underpin multi-year growth. Upcoming opportunities in AMCA and UAV platforms, along with export expansion (target 10% of turnover in 3 years), strengthen long-term prospects. We value BEL at 48x FY27E EPS and maintain a BUY rating with a target price of Rs.504.

Key Concall Highlights

* EBITDA margins are expected to sustain >27% due to favorable product mix and cost optimization.

* Order Pipeline: Emergency procurement orders worth Rs.1,350cr received; Rs.2,000cr in pipeline.

* The much-awaited QRSAM order is expected by FY26-end, with an execution timeline of over 5–6 years.

* Large Programs: NGC subsystems (~Rs.4,500cr this year), LCA avionics (~Rs.2,500cr), GBMES (~Rs.1,500–2,000cr).

* The exports target is 10% of turnover in the next 3 years (currently 3–4%).

* Capex planned Rs.1,400cr for the Defence System Integration Complex in Andhra Pradesh for QRSAM and future programs.

* Long-Term Bets: AMCA consortium participation; Archer UAV prototypes completed; Archer-NG and MALE UAV bids planned.

* In the execution front, H2 deliveries include LRSAM, Himshakti, Akash Army, Arudhra radar, D-29 EW, avionics LRUs, and electronic fuses

For More Geojit Financial Services Ltd Disclaimer https://www.geojit.com/disclaimer

SEBI Registration Number: INH20000034

2.jpg)