How to Handle a Sideways Market When Things Aren`t Moving Much

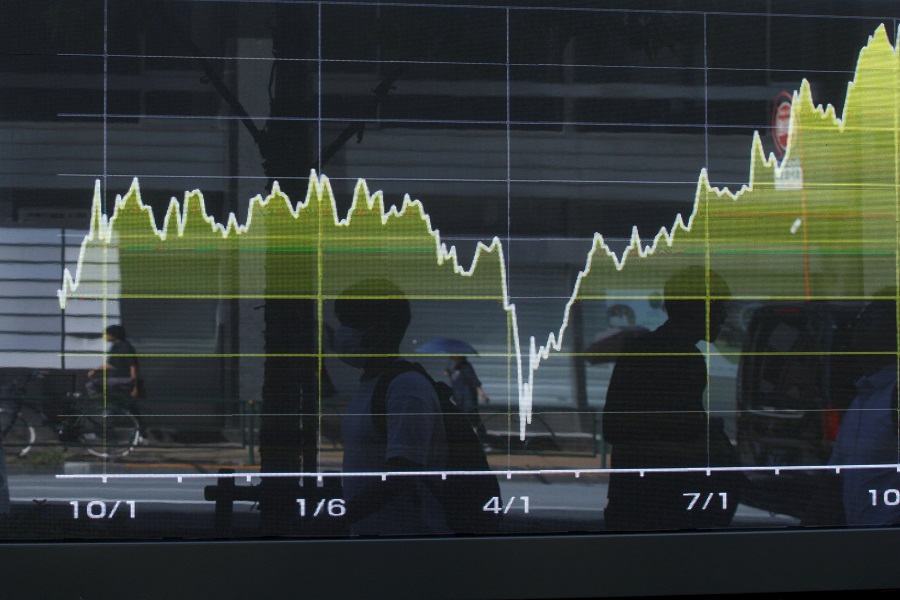

Sometimes the market just… stalls. Stock prices bounce back and forth within a narrow range, without the highs and lows that usually offer trading opportunities. This “sideways” market phase can feel frustrating because it seems like there’s little room to make moves. But don’t worry; there are ways to stay engaged and make smart decisions, even in quieter times. Here are some tips to make the most of a sideways market.

### 1. *Look at Dividend Stocks*

If stock prices aren’t climbing, dividend-paying stocks can still bring in steady returns. These companies pay out dividends to shareholders, providing a way to earn income even when stock values are flat. You’ll be getting paid simply for holding shares. Over time, reinvesting those dividends could help you grow your portfolio, especially when the market picks up again.

### 2. *Try Range-Bound Trading*

In a sideways market, stock prices often stay within a certain “range.” If you can spot that range, you can use it to your advantage:

- *Buy at the Bottom:* When a stock reaches the low end, consider buying.

- *Sell at the Top:* When it hits the upper limit, think about selling.

This approach lets you work with predictable price swings. It’s a relatively straightforward way to make gains, but it’s important to set clear entry and exit points to avoid surprises if the stock breaks out of its range.

### 3. *Consider Options for Extra Flexibility*

Options can add some interesting moves in a stagnant market. For example:

- *Covered Calls:* If you hold shares, you can sell call options on them to earn premium income. This gives you extra earnings if the stock price doesn’t exceed a set point.

- *Iron Condors and Straddles:* These strategies use a combination of options to profit from minimal price movement within a specific range.

Options strategies come with risks and complexities, so it’s important to fully understand them before diving in—or consult a professional for guidance.

### 4. *Revisit and Diversify Your Portfolio*

Sideways markets can be a good time to take a step back and review your portfolio:

- *Rebalance Investments:* Check if your assets align with your financial goals and make adjustments if necessary.

- *Explore Other Investments:* You could look into areas like bonds, real estate, or commodities, which may provide returns that aren’t as closely tied to the stock market’s movements.

A diversified portfolio can help provide stability during uncertain or low-activity periods.

### 5. *Build Your Skills*

Sideways markets don’t offer as many fast-paced opportunities, which makes them a good time for personal development. Dive into technical analysis, explore new strategies, or read up on market trends. The more you learn during these quiet times, the more ready you’ll be when things start moving again.

### 6. *Search for Undervalued Stocks*

In times of market stagnation, certain stocks might go under the radar and become undervalued. Take a closer look at companies with solid fundamentals—strong balance sheets, steady earnings, and competitive advantages. These companies may be worth investing in now and could perform well when the market becomes more active.

### 7. *Build Surplus Cash Funds*

During a sideways market, consider building up a cash reserve and putting it in low-risk investments like fixed deposits (FDs) or bonds. These funds can grow at a steady rate and remain accessible for future opportunities. When the market starts showing movement again, you’ll have cash on hand to take advantage of potential buys without needing to sell other assets.

### 8. *Practice Patience*

A sideways market can test your patience, but it’s usually best to avoid making impulsive moves. Over-trading can lead to higher fees and an over-complicated portfolio. Stick to your long-term strategy, and remember that every phase of the market cycle is temporary.

### 9. *Review Your Finances*

While the market is quiet, focus on strengthening your own financial foundation. Build up your emergency fund, pay down debt, or revisit your long-term financial plan. Taking care of your overall finances can help you be better prepared to invest when more opportunities arise.

### *In Summary*

Sideways markets may not feel exciting, but they don’t have to lead to inaction. Focusing on things like dividends, range-bound strategies, options, diversification, and building surplus cash funds can help you stay active and even grow your portfolio. When the market is calm, it’s also a perfect time to learn more about investing and strengthen your financial plan. A steady, patient approach can pay off in the long run, even when the market feels like it’s standing still.

*Disclaimer:* This article is for informational purposes only and should not be considered financial advice. Investing in the stock market involves risks, and past performance is not a guarantee of future results. Strategies discussed here may not suit all investors, as they don’t consider individual financial situations, risk tolerance, or goals. Before making any investment decisions, consult a financial advisor or do thorough research to assess risks and make choices that suit your personal circumstances.