Gold, Silver Trim Losses as Dollar Retreats - HDFC Securities

GLOBAL MARKET ROUND UP

Gold and silver reversed early losses to finish with modest gains on Tuesday, supported by a retreat in the US dollar amid mixed US macroeconomic data.

The dollar weakened after the ADP report showed that U.S. employers shed an average of 2,500 jobs per week over the four weeks ending November 1. However, stronger-than-expected housing market data limited the dollar's downside; the November NAHB housing market index unexpectedly rose to a seven-month high.

Market participants are now seeking more clarity on the macro front and will be closely watching tomorrow’s September jobs report for fresh insights into the strength of the U.S. labor market. Additionally, the Federal Reserve’s latest meeting minutes, scheduled for release later today, are expected to offer further guidance on the interest-rate outlook and may influence gold prices in the near term. Crude oil prices increased in range-bound trading on Tuesday, following remarks from Kaja Kallas, the EU's top diplomat.

Her remarks fueled speculation that the EU may tighten sanctions on Russian energy, particularly after she described Russia's recent aggression against the EU—including an explosion in Poland—as acts of terrorism. In the near term, we anticipate that crude oil prices will continue to consolidate within a broader range.

The market is now awaiting today's government weekly storage report. Natural gas reversed earlier losses, closing slightly higher as forecasts turned colder. The shift in weather patterns toward colder temperatures has lent support for natural gas prices.

Additionally, the European Union's tightening of sanctions on Russia may further reduce natural gas flows into Europe, where colder temperatures are also expected. Industrial metals broadly declined on Tuesday amid continued uncertainty surrounding the U.S. and Chinese economies.

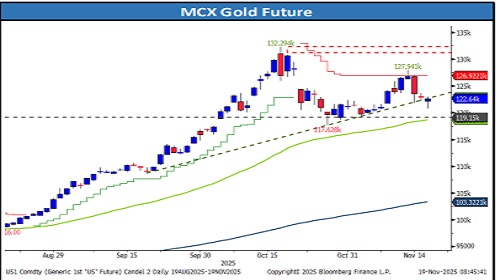

Gold

* Trading Range: 121500 to 124100

* Intraday Trading Strategy: Buy Gold Mini Dec Fut at 122450-122475 SL 121300 Target 123125/123525

Silver

* Trading Range: 154025 to 158080

* Intraday Trading Strategy: Buy Silver Mini Nov Fut at 156050-156075 SL 155025 Target 157450/158080

Crude Oil

* Trading Range: 5275 to 5500

* Intraday Trading Strategy: Buy Crude Oil Dec Fut at 5320 SL 5265 Target 5405/5450

Natural Gas

* Trading Range: 375 to 405

* Intraday Trading Strategy: Buy Natural Gas Nov Fut at 380-382 SL 374.80 Target 392/397

Copper

* Trading Range: 984 to 1006

* Intraday Trading Strategy: Sell Copper Nov Fut at 1001-1002 SL 1006.95 Target 992/988

Zinc

* Trading Range: 297.95 to 306

* Intraday Trading Strategy: Buy Zinc Nov Fut at 299.5 SL 297.05 Target 302.5/304.0.

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ00017133

.jpg)