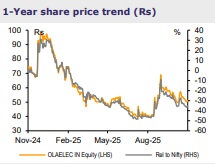

Buy Ola Electric Mobility Ltd for the Target Rs.65 By Emkay Global Financial Services Ltd

Product and cost structure in place; volume ramp-up key

Ola logged a soft Q2 with consol revenue down 43% YoY to Rs6.9bn, broadly in line with consensus’ estimate. Auto EBITDA (incl other income) turned positive (~0.6%) for first time (ex ‘other income’, EBITDA loss was Rs470mn), aided by gross margin (GM) expansion (of 510 bps QoQ) to 30.7% and ~52% reduction in opex with positive CFO of Rs150mn (posted -Rs400mn after one-time festive inventory build-up). Gen-3 transition is largely done (90%+ scooters), and Ola has begun pilot deployments of 4,680 in-house cells (full migration over next 6-9M). The management revised its FY26 guidance, and now targets ~100k deliveries in H2 (~220k units for FY26 vs 325-375k units, prior) and FY26 consol revenue of ~Rs30-32bn (earlier, Rs42-47bn) with revenue guidance for the BESS business at Rs12bn in FY27P. While we cut FY26E/27E/28E volume by 20%/14%/12%, decline in revenue is limited to 16%/7/%/2% as we build in BESS revenue from FY27E. We retain BUY (refer to our IC; Link) with unchanged SoTP-based TP of Rs65 at 5x Sep-27E EV/S + 2x P/B for the cell business.

Healthy gross margin despite subdued topline performance

Consol revenue was down 43% YoY at Rs6.9bn (in line with Consensus’ estimates) with Auto business ASPs up 6% YoY/8% QoQ to Rs131K. Consol gross profit was down 5% YoY at Rs2.1bn; however, GM expanded by 500bps QoQ at 30.9% on account of lower RM costs. EBITDA losses stood at Rs2bn (Consensus: Rs2.3bn), with EBITDA margin at -29.4% (vs 31% in Q2FY25/28.6% in Q1FY26). Overall, APAT stood at ~Rs4.2bn (in line with consensus’ estimates) on the back of higher depreciation.

Earnings call KTAs

1) The e-2W industry was broadly flat, and the company is prioritizing margin improvement and business model stability over capture of volume-led market share. 2) Guidance: ~100k deliveries in H2 (implying 220k units for FY26 vs 325-375k earlier) with FY26 consol revenue of ~Rs30-32bn (earlier, Rs42-47bn). 3) Gen-3 product transition is largely complete (~90% scooters now Gen-3); PLI benefits partially contributed in Q2; full PLI benefit should come from H2. 3) Auto GM have improved to ~30.7% in Q2 and is expected to expand further (~36-37%) with full PLI pass-through, higher MoveOS subscription revenue, and aftermarket/parts penetration (expects parts and accessories revenue to rise to ~5–6% of revenue vs 2.5% currently, providing an additional ~2-3% GM uplift). 4) Over next 6-9M, auto 2W volume will migrate to Ola’s in-house manufactured cells, creating demand of 2-3GWh annually for the cell business. 5) Motorcycle volumes accounted for ~12-15% of total EV volumes in Q2. 6) Ola launched its BESS product line using the same battery platform (4,680), with broader channel rollout in the first half of Jan-26. 7) BESS pricing ranges at Rs50k-200k with average ASP of ~Rs150k; the mgmt highlighted that GM is healthy (~40-50%); it expects ~Rs1bn in BESS revenue in Q4, (7k-8k units), and guides for ~Rs10-12bn revenue in FY27 (~60k– 70k units). 8) Ola launched HyperService, giving customers access to genuine parts and third-party garages with aim to improve customer experience, lower warranty costs, and unlock a high-margin parts business (>50% GM potential).

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354