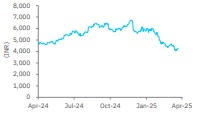

Accumulate LTIMindtree Ltd For Target Rs. 5,180 By Elara Capital

Revival plan in place, execution awaited

LTIMindtree (LTIM IN) reported a 0.7% USD revenue drop in Q4, tad lower than our expectations. However, moderation in subcon costs helped maintain margin at 13.8% in Q4. For FY25, LTIM reported a 5%/4.8% revenue growth in CC/USD terms. TCV for FY25 was up 6% to USD 6bn. The new CEO mentioned that he is targeting to revive revenue growth through i) simplifying the organization structure for faster decision-making (without any major change), ii) focusing on winning large deals, iii) sales efficiency i.e., helping clients in multiple service lines, which is the need of the hour. LTIM is re-looking at its cost structure and expects some cost rationalization, which will likely improve margin in the near to medium term. We reiterate Accumulate.

Consumer and Healthcare verticals and Europe geography weak: LTIM’s reported revenue declined 0.6% QoQ even as revenue was up +6.3% YoY in CC. USD revenue declined by 0.7% QoQ, but was up +5.8% YoY. INR revenue growth was +1.1% QoQ/+9.9% YoY. In Q4, only RoW market reported a sequential rise of 2.9%, while the US and Europe markets reported a sequential drop of 1% and 2%, respectively. Vertical-wise, BFSI and Manufacturing led growth in Q4 (up 1.2% QoQ/2.3% QoQ respectively). Other verticals, especially Healthcare, reported a QoQ drop. LTIM reported a strong TCV of USD 1.6bn in Q4. LTM attrition was up 10bps QoQ to 14.4%. LTIM reported a net decline of 2.5K in headcount in Q4.

Steady margin supported by lower subcon costs: EBIT margin was flat sequentially at 13.8%, led by a reduction in subcon cost and various cost levers driving operational efficiencies (such as overhead optimization). LTIM has launched its ‘Fit for Future’ margin expansion plan, aimed at cost optimization and productivity improvement, supported by various longterm margin levers such as cost optimization in subcon cost, pyramid correction (it hired ~5K freshers in FY25) and continued focus on improving utilization. However, LTIM has refrained from giving any margin expansion guidance.

Maintain Accumulate with TP pared to INR 5,180: LTIM has laid a strong foundation in the past 18-24 months. It has won 45+ large deals (14 deals in USD 100mn bucket; 21 deals in USD 50-100mn bucket) with a total TCV of USD 2bn+. LTIM has added 150+ new clients in that period. Large deal pipeline also reached USD 5bn+. We draw comfort from LTIM’s stable leadership and the new CEO’s intent to simplify the organization structure without any major changes. The focus is now clearly on growth revival. We may not see an immediate result in the form of a revival in revenue growth and near-term margin expansion, but a foundation to prop revival in the medium-to-long term will be laid.

We cut our FY26E/27E revenue estimates within 5-9% range to factor in low growth. The cut in earnings estimates is steeper (FY26E/27E earnings estimates cut by 9-13%) since we are now building in conservative margin expansion of 70bps in FY25-27E. So, we cut our TP to INR 5,180 (from INR 6,430) as we now value LTIM at 28x FY27E P/E (30x earlier). Key risks to our estimates are lower-than-expected revenue and margin growth.

Please refer disclaimer at Report

SEBI Registration number is INH000000933