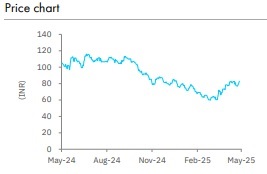

Buy Restaurant Brands Asia Ltd for Target Rs.100 by Elara Capitals

SSSG rekindles

Restaurant Brands Asia (RBA IN) posted in-line Q4, as Burger King (BK) India delivered a robust 14% YoY revenue growth on 5.1% SSSG, driven by a recovery in ADS and traction in dine-in. RBA will focus on three levers – Dine-in growth, digital sales and profitability. BK India’s gross margin was steady at 67.8%, the target is to reach ~69% by FY29. Losses of Indonesia business reduced 78% QoQ (achieved 98% of pre-boycott movement sales). Expect store addition CAGR of 12.4% and SSSG of 3-3.5% till FY28E. We introduce FY28E and upgrade FY26E-27E revenue/EBITDA estimates by 1.5-2.5%, with profitability largely unchanged. The stock has climbed 14% post our upgrade in Q3. We Retain Buy with SoTP-TP of INR 100.

Growth in ADS drives robust SSSG: BK India’s revenue grew 14% YoY, as estimated. The SSSG print came in strong at 5.1% YoY (positive after two quarters), backed by a 3% YoY pick-up in ADS. Dine-in traffic grew 9% YoY, and the share of dine-in was at 57% (+200bps YoY). Expect SSSG in the range of 3-3.5% in FY25-28E. RBA emphasised three key pillars: a) driving dinein traffic (by focusing on menu innovation, value offerings and BK Café), b) strengthening digital sales, and c) profitability. BK India added net three stores in Q4 (total stores-513), up 12.7% YoY. RBA aims to reach 800 stores by FY29. We expect a 12.4% store CAGR in FY25-28E. Going ahead, RBA aims to open stores evenly in Q1, Q2 and Q3 (earlier, mostly in Q3).

Indonesia operations continue to improve: RBA’s Indonesian arm witnessed continued store rationalization. It closed four stores, taking the total to 143 in Q4. This pared down revenue by 9.9% YoY. Initial signs of recovery were seen as ADS was up by 5%. RBA achieved 98% of pre-boycott movement (Israel-Palestine conflict) sales. SSSG was at 2.0% (versus an average 8.2% decline in 9M). We model in nil store addition in FY25-28E as RBA may continue to rationalize store network in FY26. Progress on profitability was encouraging as losses reduced by 78% QoQ. Sustained ADS and ongoing cost control are key levers for a turnaround.

Gross margin – Steady show: Gross margin for the Indian operations was stable at 67.8%, despite strong SSSG, which we believe was due to focus on value offerings. RBA targets ~69% GM in four years (by elevating 0.5-0.7% each year). RBA seeks to align its gross margin with peers, we expect 68.8% GM by FY28 (67.7%-FY25). RBA aims to curtail cost overheads at India and Indonesian operations to prop margin. Despite Standalone EBITDA margin drop of 37bps QoQ, consolidated EBITDA margin rose 68bps QoQ, on loss reduction at Indonesian operation.

Retain Buy; TP unchanged at INR 100: Q4 performance was encouraging and in line with the ongoing recovery in the QSR industry. Store addition CAGR of 12.4% will continue to support growth. Reducing losses at the Indonesian operations and gross margin elevation efforts at BK India augur well and will be key drivers for a rerating in valuation. Improved ADS led by value offerings, and growth at BK Café shall drive SSSG. Led by robust SSSG, we raise revenue/EBITDA estimates by 1.5%/2.5% for FY26E-27E, while profitability estimates are unchanged. We introduce FY28E. The stock has climbed 14% post our upgrade in Q3. We retain Buy with TP unchanged at INR 100, valuing BK-India at 27x EV/EBITDA (pre-IndAs) and Indonesian arm at 2x EV/sales.

Please refer disclaimer at Report

SEBI Registration number is INH000000933