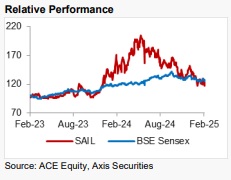

Hold Steel Authority of India Ltd For the target Rs. 115 By the Axis Securites

Recommendation Rationale

Spreads likely to improve slightly in Q4FY25: Blended Coking coal costs are expected to come down by ~Rs 1,000/t QoQ in Q4FY25, led by declining imported coking coal prices. Average blended NSR in Jan’25 was down by ~Rs 1,000/t at Rs 48,500/t; however, prices are likely to increase in coming months as market sentiments are now positive for flat steel. This could improve spreads slightly QoQ in Q4FY25.

Higher Capex intensity ahead for expansion projects: SAIL will raise its capacity to 35 MT from 20 MT currently in phases with a total capex of Rs 1.1-1.2 Lc Cr. In Phase I it will add 7.5 MT capacity by FY31 where it has got stage I approval for the IISCO greenfield steel plant, Bokaro and Durgapur expansion and for phase II it is in the process of getting the stage-I approval for the Rourkela and Durgapur steel plant which will add another 7.5 MT capacity.

Borrowings are down QoQ, but the risk of increasing leverage remains: Total borrowings currently stand at Rs 32,600 Cr, down from Rs 35,596 Cr as of the end of Q2FY25. The company has guided to reduce the borrowings to ~Rs 30,500 Cr, which will be similar to the level seen at the end of FY24. During the expansion phase, it will target D: E of 1:1; however, execution risk remains as expansion capex kicks in from FY27 onwards.

Sector Outlook: Cautious

Company Outlook & Guidance: SAIL’s Capex execution will be a key monitorable and also a key risk once its expansion Capex starts from H2FY26/FY27 and peaks in FY28/29. FY25 Capex guidance is at Rs 5,700 Cr (Revised down from Rs 6,000 Cr). FY26 capex will be higher at Rs 7,500 Cr as some portion of it will go for the start of the expansion projects. Crude steel production guidance is 18.5 MT (revised down from 19.2 MT earlier). Sales volume will be at ~17.5 MT (revised down from earlier guidance of 18 MT).

Current Valuation: 6.0x EV/EBITDA on Dec’26E EBITDA (From Sep’26E earlier).

Current TP: Rs 115/share (From Rs 130/share)

Recommendation: We maintain our HOLD rating.

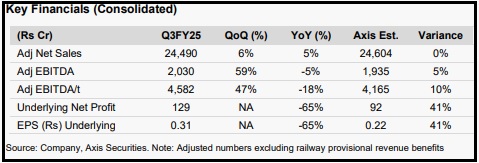

Financial Performance: SAIL reported largely in-line numbers amidst weak steel prices and post-weak Q2FY25 results. Adj Revenue (up 5%/6% YoY/QoQ) stood inline with our and consensus estimate. Crude steel production and Sales volume stood at 4.63 MT (down 3% YoY/QoQ each, 6% below our estimate) and 4.43 MT (up 16%/8% YoY, 5% below our estimate), respectively. Adj EBITDA (adjusted for provisional rail price impact) stood at Rs 2,030 Cr (down 5% YoY, but up 59% QoQ on impacted Q2FY25), a 5% beat vs. our estimate (a 2% miss against consensus) aided by lower employee cost and other expenses. Adj PAT stood at Rs 129 Cr (down 65% YoY, vs loss of Rs 354 Cr in Q2FY25), 41% ahead of our estimate, led by higher other income and lower interest expense partly offset by higher D&A.

Outlook: • SAIL’s next phase of the Capex wave raises concerns as it completed its earlier hot metal expansion plan from 14.6 MT to 25 MT after significant delays and Capex overruns. As Capex for the next phase of the expansion plan will start from H2FY26/FY27 onwards, leverage will be the key factor to monitor in the future. We factor in lower NSRs and cut our EBITDA estimates for FY26/27E.

Valuation & Recommendation: • We value the company at 6.0x Dec’26E EBITDA (from Sep’26E) to arrive at a target price of Rs 115/share (from Rs 130/share). The TP implies an upside of 8.4% from the CMP. We maintain our HOLD rating on the stock.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633