Buy Aurobindo Pharma Ltd For the target Rs. 1,500 By the Axis Securites

Recommendation Rationale:

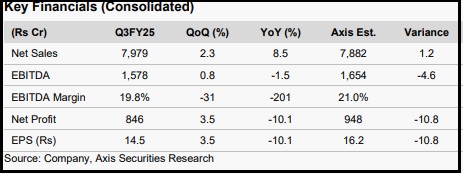

Revenue increases in the European, Growth Markets, and ARV segments were offset by declines in the US and API segments. In the US market, injectable sales saw a $77 Mn decline, representing a 6% QoQ drop. This reflects significant price erosion despite an additional $10-$15 Mn in revenue from gRevlimid. • Gross margins improved by 130bps YoY but declined by 38bps QoQ. EBITDA margins decreased by 200bps YoY and 31bps QoQ. Reported profit stood at Rs 846 Cr, falling short of the Rs 948 Cr expectation.

Sector Outlook: Positive

Company Outlook & Guidance: Aurobindo has allocated Rs 7,000 Cr in Capex over the past two years, focusing on areas such as Biosimilars and Pen-G (API). The company’s future valuations will largely hinge on the return on invested capital (ROIC) generated from this significant investment

Current Valuation: PE 20x for FY26Eearnings (Earlier Valuation: PE 22x)

Current TP: Rs 1,500/share (Earlier TP: Rs 1,500/share)

Current TP: Rs 1,500/share (Earlier TP: Rs 1,500/share)

Financial Performance

Aurobindo Pharma's Q3FY25 results were below expectations, with US revenue at $435 Mn, showing minimal QoQ growth. Revenue increases in the European, Growth Markets, and ARV segments were offset by declines in the US and API segments. In the US market, injectable sales declined by $77 Mn, representing a 6% QoQ drop, reflecting significant price erosion despite an additional $10-$15 Mn in revenue from gRevlimid. • Gross margins improved by 130 bps YoY but declined by 38 bps QoQ, while EBITDA margins contracted by 200 bps YoY and 31 bps QoQ. Reported profit stood at Rs 846 Cr, missing the Rs 948 Cr expectation.

• Eugia III unit: This unit has recently received an Official Action Indicated (OAI) status from the USFDA. It is a significant facility that covers injectables and ophthalmology, with 111 approvals already secured and 29 approvals currently under review. This development could potentially have a negative impact on Aurobindo Pharma's upcoming launches.

Outlook

The Injectable Business contributes $300 Mn in revenue, accounts for 25% of US sales, and has the highest gross margins. However, the injectable segment's OAI status may negatively impact new launches. Additionally, price erosion within the injectable portfolio poses a risk to gross margins in the upcoming quarters. • Despite this, the newly commenced plant in Vizag could support new injectable launches. Aurobindo Pharma has invested Rs 7,000 Cr in Capex over the last two years, primarily in segments such as Biosimilars and Pen-G (API). The company’s valuations in the coming years will be influenced by the return on invested capital (ROIC) generated from this Capex, with ROIC improvement expected in 2HFY26. • Despite these challenges, considering favourable industry trends and investments in high-growth segments, Aurobindo Pharma is projected to deliver a Revenue/PAT CAGR of 8.5%/14.5% over FY24-27E.

Valuations & Recommendation • Aurobindo Pharma has promising future prospects with upcoming product launches and strategic initiatives in areas such as entry into Biosimilars, peptides, and CDMO services. We maintain our BUY recommendation on Aurobindo Pharma with a target price of Rs 1,500/share.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633