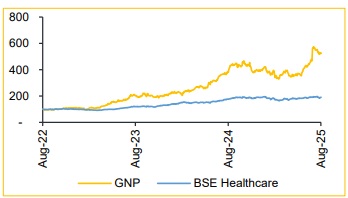

Buy Glenmark Ltd for the Target Rs.2,530 by Choice Broking Ltd

Growth Revival Backed by Pipeline and AbbVie Deal

Although Q1 results came in below our estimates, with revenue flat YoY as well as QoQ and slight margin contraction, we believe GNP is past its transition phase and poised for strong growth across regions and metrics. A healthy product pipeline of new launches (including Para IVs) alongside its legacy portfolio, such as Ryaltris and Winlevi, expected to enter new EU and EM markets, should underpin regional growth. Further, the licensing deal with AbbVie (July-25) will enhance EBITDA margin by ~535 bps in FY26E to 23%. With ISB 2001 providing long-term revenue visibility via royalties and milestone payments, we continue to value the company on a DCF-based approach (see Exhibit 1). Our target price is revised marginally to INR 2,530 (from INR 2,545), implying 23.9% upside, and we maintain our BUY rating.

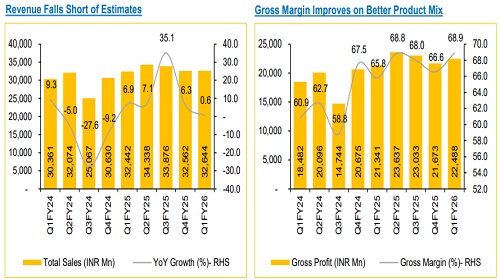

Muted Revenue; Margins Stable, PAT Below Estimates

* Revenue was flat YoY and QoQ at INR 32.6 Bn (vs. CIE est. INR 35.7 Bn).

* EBITDA declined 1.3% YoY and grew 3.5% QoQ to INR 5.8 Bn, with margin at 17.8% (vs. CIE est. 18.5%).

* APAT grew 15.0% YoY / 1.8% QoQ to INR 2.9 Bn (vs. CIE est. INR 3.8 Bn). ? Company also reported exceptional items worth INR 3.2 Bn as provision for certain legal settlement payments.

Broad-based Growth as Glenmark Moves Past Transition

Glenmark’s transitionary phase is over, with healthy growth expected across regions:

* India: Revenue declined due to discontinuation of tail-end brands. However, new launches in oncology (Tevimbra, Brukinsa) will help the company continue outperforming IPM.

* North America: Launched three products during the quarter, including a generic Adderall. With 52 ANDAs pending (24 Para IVs), we expect revenue to pick up from H2.

* Europe: Winlevi launched in the UK; entry into other EU markets planned by FY26-end. Pending respiratory launches to drive double-digit growth in FY26E.

* Emerging Markets: Russia and MEA posted strong growth, offsetting slower LATAM and APAC. Ryaltris launch in Brazil and China will support continued double-digit growth.

AbbVie Deal Eases Innovation Funding, Supports Margin Expansion

The company’s recent transaction between IGI (wholly-owned subsidiary) and AbbVie for ISB 2001, valued at USD 1.93 Bn, renders IGI self-sustaining. This significantly eases GNP’s innovation funding burden and is expected to support robust expansion of EBITDA margin, projected to reach ~23% in FY26E.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

.jpg)