Neutral Colgate Palmolive Ltd For Target Rs. 2,940 By Yes Securities Ltd

Ltd ( 1 ).jpg)

Earnings pressure could sustain till 1QFY26

Colgate-Palmolive (India) Ltd. (CLGT) 3QFY25 performance was below our expectations largely due to lower imputed realizations and higher other overhead cost. Soft urban demand and plateauing rural growth pace will put pressure on topline growth going forward as well. Also, benefits from relaunch/restaging done in 2HFY24 for core brands is now starting to come into the base. Momentum in premium portfolio with support from further innovations, packaging upgrade, accessible sku’s and high decibel campaign to aid near-term growth. CLGT is also lapping up high margin base and we believe CLGT will leverage its current healthy margins to invest behind brands/innovations to drive topline growth. There is 4.2%/3.1%/3.2% cut in our FY25E/FY26E/FY27E EPS. Due to the recent pressure on sector valuations, we now assign 45x on FY27E EPS, giving us a revised target price (TP) of Rs2,940 (Rs3,375 earlier). We thus downgrade our rating a notch to NEUTRAL. Update on diversification being explored in personal care will aid rerating.

Result Highlights

* 3QFY25 headline performance: Revenue (including other operating income) grew by 4.7% YoY to Rs14.6bn (vs est. Rs15.1bn). EBITDA de-grew by 3% YoY to Rs4.5bn (vs est. Rs4.8bn). Adjusted PAT (APAT) was down 2.2% YoY to Rs3.2bn (vs est. 3.4bn).

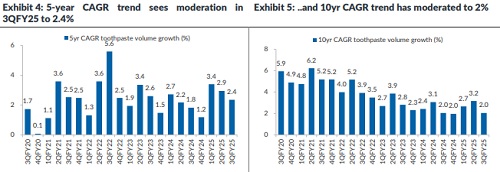

* Domestic revenue grew 3.2% (mid-single digit volume growth in toothpastes) in 3QFY25 and 8.8% in 9MFY25.

* Margins: Gross margin was 69.9% (down ~230bps YoY and 140bps QoQ; vs est. 69.7%). Lower Advertising spends (down by 90bps YoY to 13.7%; -2% YoY on absolute basis) and Staff cost (down 40bps YoY) was largely offset by increase in Other Overheads (up 160bps YoY). Thus, EBITDA margin was down by ~250bps YoY to 31.1% (vs. our est. 31.7%).

* 9MFY25 revenue, EBITDA & APAT were up 9.2%, 6.7% & 7.9% YoY respectively. Gross margin stood flattish YoY at 69.7% while EBITDA margin was down 80bps YoY to 31.9%.

Excerpts from press release

(1) Quarter saw relatively soft demand, particularly in the urban market. Near term macro environment continues to look challenging. (2) Toothpaste reported mid-single digit intrinsic volume growth while Toothbrushes saw continued competitive growth. (3) Premium portfolio continued to see positive momentum, driven by science-backed innovations. (4) Innovation pipeline: Introduced MaxFresh Sensorial range in e-Commerce, building on the success of Visible White Purple.

View & Valuation

There is 4.2%/3.1%/3.2% cut in our FY25E/FY26E/FY27E EPS. We now build ~9% revenue CAGR over FY24-FY27E (way higher than the ~4.9% CAGR delivered over the last five years) led by (a) Mid-to-high single volume growth in near-term especially from rural markets, (b) Momentum in premium portfolio with support from innovation, packaging upgrade, accessible sku’s and high decibel campaign, (c) Continues improvement in ASP led by premiumization and pricing action (to combat inflation). Assuming current margin profile stays and sees further modest improvement in FY26 & FY27, we see 12.4% EBITDA CAGR over FY24-FY27E (~290bps EBITDA margin expansion largely led by gross margin improvement; good chunk of improvement already visible in 9MFY25). CLGT is currently trading at ~52x/46x/41x on our FY25E/FY26E/FY27E EPS as we build 14.6% earnings CAGR. Improved margin profile & working capital, better cash generation, enhanced return ratios, diversification in personal care space and softer aspect of recent volume growth disclosures merits better target multiple, but market conditions restrict us. We thus assign 45x on our FY27E EPS, giving us a revised target price (TP) of Rs2,940 (Rs3,375 earlier). We thus downgrade our rating a notch to NEUTRAL. Update on diversification being explored in personal care will aid rerating.

Please refer disclaimer at https://yesinvest.in/privacy_policy_disclaimers

SEBI Registration number is INZ000185632

Ltd.jpg)