Buy Can Fin Homes Ltd for the Target Rs. 850 by Axis Securities Ltd

An improved show

A better quarter on growth and asset quality

Can Fin delivered a healthy quarter with revival in disbursements, resilience in margins, significant reduction in SMA 0 and some correction in GNPLs. ECL provision release from SMA pool decline and reversal of prior-period tax were utilized for augmenting Management Overlay by Rs250mn and improving the PCR on Stage-3. Notwithstanding this, the RoA/RoE for Q4 FY25 stood at 2.6% and 18.5% respectively

Disbursements jumped from Rs18.8bn in Q3 FY25 to Rs24.55bn, aided by recovery in business run-rate in KTK (some easing in E-Khata releases) and sustained strong traction in North region (disbursements up ~30% yoy in FY25) and TN (disbursements up ~25% yoy). With stable BT Out (no impact after first Repo cut), the loan portfolio grew by 3% qoq/9% yoy. LAP and Top-up loans (though both are small in portfolio share) are consistently growing faster and customer mix has been shifting towards the self-employed. Portfolio Spread declined by 6 bps, largely contributed by contraction in portfolio yield due to higher growth in higher-ticket HL and loan repricing for stronger customer profiles. CoF increased marginally due to significant incremental borrowings from NCDs and tighter market conditions. There was a substantial reduction in SMA 0 with stronger follow-ups, but there was an increase in SMA 1 & 2 buckets. Credit cost in the quarter mainly represented addition to Management Overlay.

Management expects 20% disbursement growth, largely stable margins and 15 bps credit cost in FY26

Can Fin expects 20% disbursement growth in FY26 premised on 1) further easing in KTK E-Khata issue, 2) sustenance of reasonably strong traction in North and TN markets, 3) rebound in Telangana business, 4) increase in business productivity from newly established Sales team and 5) improvement in business volume from the branches added in FY24/25. Management expects 10 bps CoF decline in Q1 FY26 and further easing subsequently with repo cuts benefitting with a lag of couple of months. Rate on incremental banks loans and NCDs would also come down. Passing of CoF benefits to existing and new customers would be based on transmission by the competition. Company expects to control and correct the SMA pool further with augmented focus and interventions and estimates GNPL level to remain around 90 bps. Hence, the credit cost has been guided at 15 bps for the year.

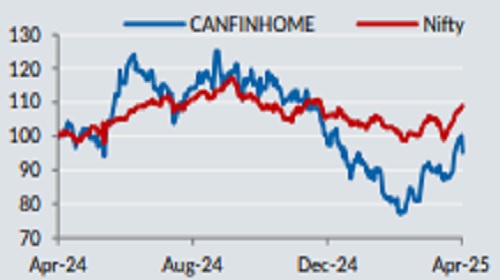

Business improvement and asset quality needs to hold-up; Retain BUY

Demonstrating further recovery in business volume and minimizing the impact from IT transition would be critical for Can Fin for delivering 12-13% loan growth in FY26. The trends in BT requests would also be an important monitorable from portfolio growth standpoint. Margin management in a downcycle would be a less-onerous task for Can Fin versus other HFCs due to high variability in borrowings. Improvement in SMA pool would give more comfort to investors. The stock trades at reasonable valuation of 9x P/E and 1.4x P/BV on FY27, and estimated loan CAGR and avg. RoE delivery over FY25-27 is 12.5-13% and 16.5-17% respectively. Retain BUY with 12m PT of Rs850.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633