Buy Bharat Heavy Electricals Ltd For Target Rs. 329 By Geojit Financial Services Ltd

Profit Growth Accelerates Fast

Bharat Heavy Electricals Ltd (BHEL), a public sector entity, is India’s largest engineering company. It supplies power plant equipment such as gas turbines, generators, thermal sets, diesel shunters, turbo sets, hydro sets, power transformers, switchgears, circuit breakers and boilers. It also manufactures compressors, valves, rectifiers, pumps, capacitors and oil rigs, and undertakes castings and forgings.

* BHEL’s Q2FY26 revenue increased 14.1% YoY to Rs. 7,512cr, driven by an 18.0% YoY surge in the industry segment to Rs. 1,836cr and a 12.9% YoY increase in the power segment to Rs. 5,676cr.

* Order inflows for Q2FY26 stood at Rs. 35,000cr, down 14.8% YoY. The power segment declined 32% to Rs. 25,992cr, while the industry segment increased 239% to Rs. 9.383cr.

* BHEL contributed to the prestigious NASA-ISRO NISAR mission by supplying space -grade solar panels and lithium-ion batteries, highlighting its advanced engineering capabilities and technological credibility in space applications

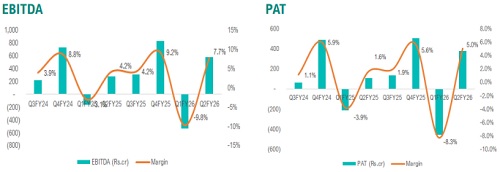

* EBITDA grew 111.2% YoY to Rs. 581cr in Q2FY26, driving an EBITDA margin expansion of 350bps to 7.7% due to a 42% decrease in other expenses to Rs. 237cr

* PAT increased more than threefold to Rs. 375cr supported by a 56.9% YoY increase in other income to Rs. 175cr.

Outlook & Valuation

BHEL delivered a steady performance, driven by strong project execution across thermal, hydro and industrial systems, supported by diversification into renewables, rail transportation and defence manufacturing. The management remained focused on improving operational efficiency, expanding the clean energy and nuclear portfolio and leveraging digital solutions for smarter project management. Strategic initiatives in EV infrastructure, advance train protection systems and aerospace components are poised to drive long-term growth visibility. Although, continued execution discipline and working capital optimisation are key near-term priorities, we are positive and upgrade our rating on the stock to BUY from HOLD, with a revised target price of Rs. 329, based on 2.4x FY27E P/S.

Key concall highlights

* BHEL received major EPC orders during Q2FY26, including the EPC contract for the 660 MW Unit 6 at the Amarkantak Thermal Power Project and the 660 MW Satpura Unit 12 project at the Satpura Thermal Power Project, underscoring strong new order momentum.

* BHEL secured a BTG supply and supervision E&C contract for the 800 MW Anuppur Thermal Power Project, signalling deeper engagement in larger scale thermal project.

* BHEL won the balance of system package for a 300 MW solar-PV project at Khavda, marking its push into solar-infrastructure solutions beyond conventional power.

* BHEL has secured its first order for the KAVACH train-protection system from Indian Railways (covering a 36 km section, which marks its entry into advanced rail safety electronics.

* New capacity additions of 1630 MW across three projects: Yadadri TPS U#1 (800 MW), Khurja STPP U#2 (660 MW) and Punatsangchhu -II HEP U#5 (170 MW) to boost power generation.

* BHEL extended its MoU with NPCIL for collaboration in implementing nuclear power plants based on PHWR technology, strengthening its long-term participation in India’s nuclear energy expansion plans.

For More Geojit Financial Services Ltd Disclaimer https://www.geojit.com/disclaimer

SEBI Registration Number: INH20000034

.jpg)