Accumulate CreditAccess Grameen Ltd for Target Rs.1,365 by Elara Capitals

Pinning hopes on H2FY26 recovery

Q4FY25 earnings for Credit Access Grameen (CREDAG IN) rebounded due to reduced provisions, but underlying core operations remain challenging. While Karnataka (31.1% of gross loan portfolio [GLP]) and Tamil Nadu (19%) challenges to persist in H1FY26 and caution in Bihar (4.8%) stays, growth revival in H2 is expected to be stronger. While the Portfolio at Risk (PAR) bucket roll-forward rates are nearing normal, headline NPA remains high, suggesting credit cost may take another year to normalize. We retain Accumulate with a higher price target of INR 1,365 on 2.2x FY27E P/ABV with meaningful valuation derating and most negative parameters peaking.

Rebound from losses: CREDAG reported a PAT of INR 472mn in Q4FY25, rebounding from a loss of INR 995mn in Q3FY25 (vs ~INR 3.9bn PAT in Q4FY24). NII stood at ~INR 8.8bn, up 1.6% QoQ but down 0.5% YoY. NIM improved by 20bp QoQ to 12.7%. Q4 marginal cost of borrowings was 9.6%, slightly below the average of 9.8%. The company continues to focus on a nimble, diversified liability mix, with rising foreign borrowings. District-based pricing and Expected Credit Loss (ECL) models aid in risk-aligned yield optimization. Management sets FY26 NIM target in the range of 12.6-12.8%.

H2FY26 to be better than H1: Q4 saw GLP grow 4.6%QoQ but down 2.9% YoY, partly offset by muted growth in Karnataka, due to elevated delinquency during February-March 2025. But borrower additions have sustained with ~0.3mn new addition, 43% being new-to-credit. Geography-wise: 1) Bihar (4.8% of GLP): GLP and borrower base declined due to a strategic pullback from September 2024 to January 2025, focused on portfolio protection amid overleveraging concerns, strong reversal in business since February 2025, 2) Karnataka (31.1% of GLP): caution on borrower accretion, GLP with 2% QoQ growth has kickstarted business momentum, 3) Tamil Nadu (19% of GLP): the recent bill had no impact on groundlevel operations or collections to date. We expect 14-15% loan growth during FY26-27E, fueled by easing regional headwinds, rising retail finance segment share from current 6% to ~10%, offset likely write-offs and business normalization in 2-3 quarters

Credit cost normalization likely in FY27: GNPA rose to 4.8% in Q4FY25, up 77bp QoQ, led by Karnataka stress where collection efficiency was at 91.9%. FY25 write-offs hit ~INR 11.2bn, with credit cost at ~INR 19.3bn (7.7%), ahead of guidance. Provision buffers remain strong. Management has set FY26 credit cost target in the range of 5.5-6.0%. Ex-bucket collection efficiency improved to 99.7% in May, indicating normalization outside Karnataka. No adverse impact is yet to be seen from TN ordinance, and stress there is as seasonal. Management expects H2FY26 to stabilize, with a structural credit cost reset to 3.0-3.5% and focus shifting to forward-looking risk metrics.

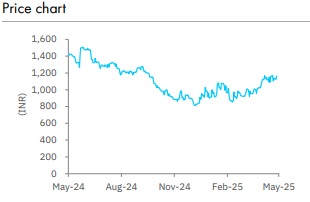

Retain Accumulate with a higher TP of INR 1,365: We pare down FY26E EPS by 10% and FY27E by 4.7% after factoring in sustained pressure in FY26. We introduce FY28E. Amid disbursements regaining pace followed by improvement in new borrower addition during Q4FY24-Q1FY25, we expect 15-16% YoY growth during FY26-27E. With normalization trends 2-3 quarters away, we expect credit cost to touch 4% and GNPA at 3%+ during FY25-27E translating into a ROA of 4.7-4.8% and ROE of 19% during FY27-28E. With an 18% stock rally in the past three months and healthy returns stacking up in FY28, we raise our price target to INR 1,365 from INR 1,042 on 2.2x (from 1.6x) FY27E P/ABV. We retain Accumulate with meaningful valuation derating and most negative parameters peaking.

Please refer disclaimer at Report

SEBI Registration number is INH000000933