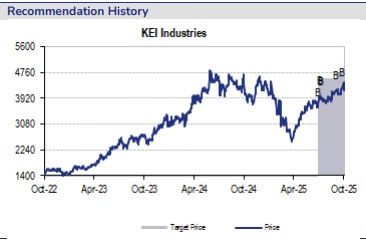

Buy KEI Industries Ltd For Target Rs. 4,820 By JM Financial Services

Confident of FY26/27E guidance despite capex delay

KEI’s 2QFY26 performance was largely in line with estimate, with revenue, EBITDA, and PAT seeing YoY growth of 20%, 22%, and 31% respectively. Volume growth stood at 15% YoY for 1HFY26, and 10% YoY for 2QFY26. While both the institutional and dealer channel performed well, within the institutional channel growth in exports massively outpaced that in the domestic institutional business, given a conscious decision to allocate a higher share of capacities to exports. We understand that the stock’s sharp reaction post 2Q results was owing predominantly to the delay in commissioning the Sanand facility, phase 1 of which is now expected by Nov’25 (Sep’25 earlier) and phase 2 by Mar’27. Despite this delay, the management has retained its guidance of 18-20% YoY revenue growth in FY26E and FY27E. We revise our FY26-28E EPS estimates by 0 to -3%. Our target price stands at INR 4,820, at 40x Sep’27E EPS. Maintain BUY.

* 2QFY26 PAT slightly ahead of estimate: KEI’s 2Q revenue at INR 27.3bn, +20% YoY was in line vs. estimate of INR 27.3bn, driven by growth in the institutional and dealer channel. 2Q EBITDA, at INR 2.7bn, +22% YoY was 2% lower than estimate of INR 2.8bn, while margins at 9.9%, rose marginally YoY (+20bps) and was slightly below estimate of 10.1%. 2Q PAT, at INR 2bn, rose 31% YoY and was 3% ahead of estimate of INR 1.9bn, driven by a strong operating performance, higher other income and lower than estimated finance costs. Volume growth stood at 15% for 1HFY26, and 10% for 2Q.

* C&W growth strong; decline in EPC is in line with management strategy: In 2Q, KEI’s cables & wires (C&W) business registered 23% YoY growth to INR 26.3bn, while the stainless steel wires (SSW) and EPC projects business registered YoY decline of 10% and 23% respectively. Here, the decline in EPC revenue is in line with the company’s strategy to limit growth in the segment. EBIT margin in the C&W business stood at 10.9%, ~40bps higher YoY.

* Growth in institutional channel outpaces growth in the dealer (retail) channel: KEI posted strong growth in the institutional and retail channel, +23% and +17% respectively. Within the institutional business, exports saw strong growth, wherein 2Q revenue stood at INR 4.3bn vs. INR 2bn in 2QFY25, while revenue from the domestic institutional business was relatively muted and EPC saw a decline of 23% YoY. This was the result of the management focusing more on exports through this quarter, and in accordance with this strategy, shifting some domestic capacities to cater to export markets. This, in turn, led to growth in exports outpacing that in the domestic business, especially the institutional (ex-EPC) portion.

* Sanand capex delayed, but guidance unchanged: Commencement of Phase 1 (elongated monsoons in Gujarat and challenges given labour shortages) and Phase 2 (higher-thanexpected complexities especially for EHV cables) at Sanand has been delayed. However, trial runs have begun in Phase 1, and full-fledged operations are expected by Nov'25. Phase 2 is also expected to be operational by Mar’27. In all, Sanand plant should drive revenue of INR 60bn upon optimal utilisation (INR 12bn from EHV cables, and INR 12bn from LV and MV power cables). Despite the delay in commencement of the new plant, revenue growth guidance for FY26 is unchanged at +18% YoY (aspiration to grow higher than this at 20%). Revenue growth guidance for FY27E is also unchanged at 20% YoY growth (endeavour to grow higher than guided). EBITDA margin should be flat YoY in FY26E and FY27E, and see a 100-150bps expansion in FY28 as EHV capacities ramp up.

Key takeaways from concall

Guidance unchanged despite delay in new capex

* Revenue guidance: Revenue growth guidance unchanged at 18% YoY. However, remain confident of growth for FY26E coming in higher than guided range, at 20%. Further, guidance for FY27E also unchanged at 20% YoY growth, while the endeavour will be to surpass this guidance as well. Will drive growth from whichever channel wherein opportunity lies, including the dealer/institutional/export channel. However, target to restrict EPC revenue to ~INR 4.5bn annually.

* EBITDA guidance: Margins should be flat YoY in FY26E and FY27E. In FY28E, expect 1-1.5% margin expansion as EHV capacities ramp up.

* Revenue growth driven by input price inflation and fairly decent volume growth: Volume growth stood at 15% for 1HFY26, 10% for 2Q and the rest was the result of input price inflation. In 2Q, copper volumes rose 18% YoY and constituted 45% of total volume (42% earlier) and aluminium volumes rose 3% and constituted the balance 55% (58% earlier), driving weighted average volume growth of 10%. This was due to strong growth in the export markets wherein consumer preference was for a higher share of copper in the product. The management also claimed that it has been able to pass on most of the price increases through bi-monthly price revisions.

* Data centres as an emerging opportunity: The management indicated that it sees data centres as an interesting emerging opportunity. Data centres require EHV cables for incoming power, MV cables for relatively smaller data centres and copper cables within the data centre. Generally, the share of C&W in total data centre stands at 8-9% of the total investment, and all SKUs required in setting up a data centre are available with KEI Industries.

* Order book: Current order book stands at INR 34.3bn. Out of this, EPC business constitutes INR 4.8bn, EHV stands at INR 6.4bn, domestic cable institutional business at INR 20.1bn, and export order book stands at INR 6.4bn. Execution of this order book is 4 months for cables and 18 months for the EPC portion.

Progress in exports

* Focus was higher on exports this quarter: All-time high revenue from export at INR 4.3bn vs. INR 2bn in 2QFY25. Have focused on exports more through this quarter, and in line with this strategy, shifted some domestic capacities to cater to export markets. This, in turn, led to growth in exports outpacing that in the domestic business, especially the institutional (ex-EPC) portion.

* Key geographies: Australia, Middle East, Africa, and a few customers in Europe and USA.

* Growth in domestic market to revert back to normal levels: This growth in the domestic market will revert to normalised levels from 3Q, once the Sanand plant commences operations.

Capacity expansion: Sanand and beyond

* Capacity utilisation: Capacity utilisation currently stands at 78% in the cable division, and 65% in the house wires division. This is calculated in terms of kilometres. Theoretically, with EHV sales ramping up, capacity utilisation will be appear to be lower than LV /MV cables ramping up.

* Delay in Sanand capex: Phase 1 and Phase 2 commencement has both been delayed. Delay in Phase 1 was owing to elongated monsoons in Gujarat and challenges from the contractor’s end given labour shortages. Expect Phase 1 to be operational for mass production by Nov’25. Trial runs have already begun, and very confident of full-fledged operations by Nov’25. Phase 2 has been delayed owing to higher-than-expected complexities especially for EHV cables. In all, the Sanand plant should drive revenue of INR 60bn upon optimal utilisation (INR 12bn for EHV cables, and INR 12bn for LV and MV power cables). Around Nov’25, around 50% of the Sanand plant will be live and should further aid growth.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361