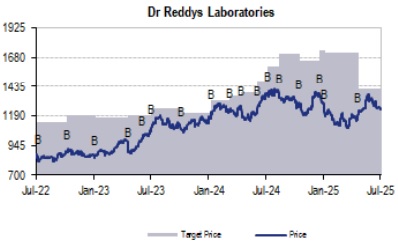

Buy Dr Reddys Laboratories Ltd For Target Rs. 1,521 By JM Financial Services

DRRD’s 1Q was a miss, though overall it reported 11%/4%/2% YoY growth for Revenue/EBITDA/PAT during the quarter, the same were -2%/-8%/-6% vs street and -8%/- 14%/-14% vs JMFe. The miss vs JMFe was on account of higher than expected price erosion in gRevlimid during the quarter. Within segments, the US de-grew (-11% ) due to price erosion. India grew 11% YoY, enabled by new launches and price increase. The overall topline growth was supported by strong performance in both Europe (+16% YoY in base business) and EM (+18% YoY due to higher volume, new launches and favourable fx rate). PSAI grew 7% YoY. Future growth will be driven by a healthy pipeline across markets, including Semaglutide and Abatacept. Margins are likely to be maintained at ~25% with flexibility on SG&A as well as R&D spend. With Semaglutide and Liraglutide launches in nearterm, DRRD remains best placed among generic players to benefit from the upcoming generic GLP-1 wave. Overall the stock remains attractive, vs large cap peers, however given the lowered guidance for gRevlimid FY26, we revise our FY26 estimates downwards. The larger story remains intact as the gRevlimid has limited contribution in FY27/FY28 estimates, thus we maintain our BUY rating with a TP of INR 1,521.

* North America de-grew 11% YoY: Growth during the quarter impacted by price erosion in select products (including Lenalidomide), though the broader mature portfolio remained stable in terms of pricing. However, DRRD still outgrew market with MAT May’25 growth being 10.8% for DRRD vs 2.3% for US generic market (source: IQVIA). gRevlimid sales during the quarter was impacted by higher than expected price erosion (despite higher volumme); the company expects similar numbers in 2Q, relatively much less sales in 3Q and left over numbers in 4Q. The US base business witnessed QoQ decline and is expected to remain flat/ experience single-digit growth depending upon product launches. The company has 20 product launches planned for remainder of year, none of them sophisticated, but could result in potential upside. This quarter saw 5 new launches, which will support recovery of the business. 1 new ANDA filed was during the quarter, taking total pending approvals to 70 ANDAs and 3 NDAs (including 43 para IVs and 22 FTFs). FY27/28 pipeline includes - Abatacept, Pembrolizumab, daratumumab, rituximab.

* India market up 11% YoY: DRRD outperformed IPM in MAT Jun’25 (DRRD +12.2% vs IPM +8.6%), ranking DRRD 10th in IPM. Growth enabled by new product launches (5 new launches during the quarter) and price increases. The new launches included 2 innovative assets during the quarter- Beyfortus (RSV Vaccine) & Sensimmune (Acarizex Slit). Company guides for consistent double digit growth in coming quarters. Future trajectory to be driven by innovative products, branded generic will support the growth but outperformance will be driven by innovative portfolio. Current MR strength stands at 10k people across 50 teams.

* gSemaglutide: The company is currently prioritising capacity towards Canada (approval is expected by October/November 2025, with launch planned in January 2026). The company will initially launch generic Ozempic in Canada as of now, generic Wegovy will be filed at a later point. Dr Reddy’s is targettig 87 markets for Semaglutide in CY26, with the majority of them being small. Key markets other than Canada are India, China and Turkey. These key markets will be targetted by March 2026. Dr Reddy’s plans to have a capacity of 12mn pens in FY27 (API to be provided by Dr Reddy’s and pen by partner), the same number will be 10mn pens in CY26. These pens will be in 1 pen/week dosage format. Dr Reddy’s continues to intend to be amongst the first entrants in most of the markets it is targetting.

* Biosimilar abatacept: The read out of phase 3 trials is expected in November 2025, with the product being expected to be ready for launch by December 2026/January 2027. Initially the product will be launched in IV format, with the subcutaneous formulation to follow a year later owing to IP considerations.

* gLiraglutide: The company is planning to launch the product in next couple of quarters. DRRD will be potentially amongst the first to market in majority of the markets for gSaxenda. However, the opportunity is not expected to be as big as gSemaglutide.

* Emerging markets up 18% YoY: The growth is driven by higher volummes, new launches (26 new launches acorss markets during the quarter) and favourable forex. Russia led the growth train (+28% YoY), enabled by volumme growth and favourable forex (+17% CC YoY growth). Whereas, RoW grew 13% YoY, driven by volumme gains and new launches, though the same was moderated due to price erosion. Meanwhile, CISR remained flat (+2% YoY).

* Europe up 142% YoY (base business +16% YoY): The overall YoY growth is inflated because of NRT acquisition (contributing INR 6.7bn, +12% QoQ). Base business growth (+16% YoY) was on account of new product launches (13 new launches excluding NRT). However, growth was partially moderated on account of price erosion. Excluding NRT, Germany/UK/France,Italy,Others grew 13%/10%/30% YoY. The Company expects future growth to be in double digit, enabled by biosimilars.

* PSAI up 7% YoY: The Growth was led by new API product launches and growth in CDMO business. However, there was a QoQ decline of 14% due to seasonality in volumes. The gross margins declined to 13% (vs 23% in Q1FY25) due to lower operating leverage. This quarter also saw 12 new DMF filings. The company has guided for double digit growth this year, with CDMO business guidance for FY26 being USD 100mn (plan to take it USD 250-300mn by FY30).

* Key financials: -

Revenue at INR 85.5bn (-2% street, -8% JMFe, +11% YoY); Miss on JMFe due to higher than expected price erosion in gRevlimid

- Gross Profit of INR 48.6bn (+5% YoY); YoY margin reduction of 360bps on account of price erosion in generics and lower operating leverage partially offset by better product mix; Guidance – gross margin to stay at similar level for FY26 - EBITDA at INR 21.5bn (-8% street, -14% JMFe, +1% YoY)

- EBITDA Margin at 25.2% (vs 26.8% street, 27.1% JMFe and 27.4% 1QFY25)

- PAT at INR 14.2bn (-6% street, -14% JMFe, +2% YoY)

- North America at INR 34.1bn (-11% YoY, -18% JMFe); miss due to price erosion

- Others up to INR 1.6bn vs INR 0.2bn in Q1FY25

- PSA at INR 9.4bn (-13% JMFe) - India (INR 14.7bn), Emerging Markets (INR 14bn) and Europe (INR 12.7bn) business largely in line with JMFe

- Major FY26 key financial guidance – SG&A at 28-29% of sales, R&D at 7-7.5% of sales, ETR at 25%, CAPEX cash outflow at INR 25-27bn

* Change in estimates: We have reduced our FY26 estimates (refer Exhibit 3) to adjust for the updated company guidance concerning gRevlimid. Owing to higher than anticipated price erosion, the company has guided for lower gRevlimid sales in FY26. The FY26 estimates are reduced on account of the same. The FY27 and FY28 estimates are largely maintained, as they don't include meaningful gRevlimid sales.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361