MCX Natural gas Dec is expected to hold the support near Rs 397 level and rise towards Rs 416 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

* Spot Gold is likely to recover further towards $4110 amid weak dollar and softening of US treasury yields. Further, fresh data showed weakening labor market conditions, fueling hopes for another rate cut from US Fed in December meeting. As per CME FedWatch tool traders are now pricing almost 50% chance of a rate cut in December, up from about 42% a day ago. Moreover, demand for safe haven may increase on escalating geopolitical tension in eastern Europe and concern over Fed independence. US President Donald Trump administrations has started interviews for next Fed Chair, fueling bets that Trump may replace with someone who would be dovish and push for more rate cuts

* MCX Gold Dec is expected to rise towards Rs124,000 level as long as it stays above Rs 121,000 level. A break above Rs 124,000 will open doors for Rs124,800 level

* MCX Silver Dec is expected to rise towards Rs156,700 level as long as it stays above Rs152,300 level

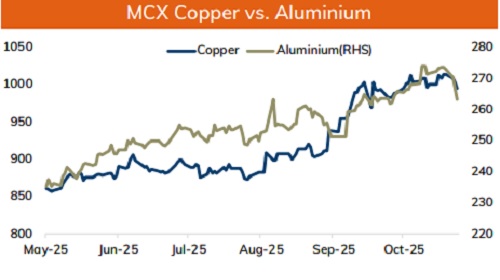

Base Metal Outlook

* Copper prices are expected to trade with a negative bias on risk aversion in the global markets. Further, prices may slip as disappointing economic data from China and US has raised concerns over demand outlook. Additionally, Yangshan copper premium, a gauge of China's appetite for importing copper dropped to $32 a ton from $58 in late September. Moreover, miner Freeport-McMoRan announced a plan to resume operations at its Grasberg mine in Indonesia. He said it plans to restart production from the 2 nd quarter of 2026, in line with previous guidance. Production from the unaffected mines at the Grasberg complex has already resumed

* MCX Copper Nov is expected to slip towards Rs 988 level as long as it stays below Rs 1004 level. A break below Rs 988 level may open doors for Rs 985-Rs 982 level

* MCX Aluminum Nov is expected to slip towards Rs 261 level as long as it stays below Rs 265 level. MCX Zinc Nov is likely to hold the support near Rs 298 level and rise back towards Rs 305.0 level

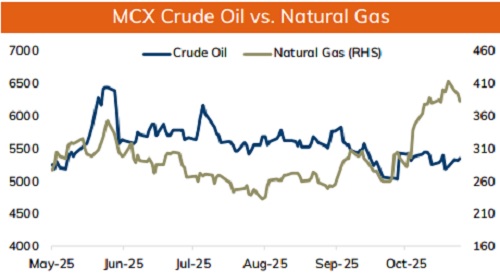

Energy Outlook

* Crude oil is likely to trade with positive bias and rise towards $61 amid weak dollar. Further, prices may rise on concerns over supply disruption from Russia due western sanctions and as Ukraine stepped up attacks on Russian energy infrastructure. Moreover, hawkish rhetoric by the EU top diplomat raised expectations that sanctions on Russia will tighten. Additionally, US President Donald Trump said Republicans are working on legislation that will impose sanctions on any country doing business with Russia. Meanwhile, investors will remain cautious ahead of slew of economic data from US that was delayed during the government shutdown. Additionally, another inventory build may hurt prices. API figures showed crude stocks rose by 4.45 million barrels in the week ended 14th November. MCX Crude oil Dec is likely to rise towards Rs 5450 level as long as it stays above Rs 5250 level.

* MCX Natural gas Dec is expected to hold the support near Rs 397 level and rise towards Rs 416 level.

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631