MCX Gold Feb is expected to slip towards Rs.136,000 level as long as it stays below Rs.138,500 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

* Spot Gold is likely to trade with the negative bias and slip towards $4400 level on strong dollar and rise in US treasury yields across curve. Further, profit booking may be seen ahead of commodity index reshuffle. Investors will remain cautious ahead of job data from US to gauge economic health of the country and get cues on interest rate trajectory. Meanwhile, demand for safe haven may increase amid escalating geopolitical tensions and ahead of U.S. Supreme Court ruling which would determine whether Trump can invoke the International Emergency Economic Powers Act (IEEPA) to impose tariffs without congressional approval. Moreover, Trump said 2027 military budget should be $1.5 trillion, fueling concerns about rising debt

* MCX Gold Feb is expected to slip towards Rs.136,000 level as long as it stays below Rs.138,500 level.

* MCX Silver March is expected to slip towards Rs.235,000 level as long as it stays below Rs.248,000 level

Base Metal Outlook

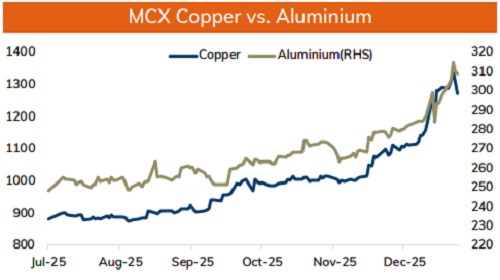

* Copper prices are expected to trade with a negative bias amid strong dollar and profit taking. Further, prices may slip on weak demand from China. The Yangshan copper premium, a gauge of Chinese consumers' appetite for imported copper, declined to $42 a ton, down from above $50 by the end of 2025. Meanwhile, sharp downside may be cushioned on supply concerns amid series of mine disruption and recurring protest. Additionally, better than expected economic data from US would provide some cushion to prices

* MCX Copper Jan is expected to slip towards Rs.1230 level as long as it stays below Rs.1295 level. A break below Rs.1230 level may open doors for Rs.1210-Rs.1200 level

* MCX Aluminum Jan is expected to slide towards Rs.302 level as long as it stays below Rs.311 level. MCX Zinc Jan is likely to face stiff resistance near Rs.310 level and slip towards Rs.304 level

Energy Outlook

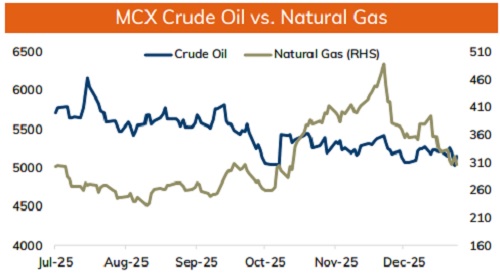

* NYMEX Crude oil is likely to trade with positive bias and rise towards $59 level on supply concerns and escalating geopolitical tensions. A Russian-bound oil tanker suffered drone attack in Black sea. Further, investors fears that Trump will allow a bipartisan sanctions bill targeting countries doing business with Russia. Moreover, prices may rally ahead of upcoming annual rebalancing of commodity indexes. However, strong dollar may weigh on prices. Further, US President Donald Trump’s plan to refine and sell Venezuelan crude oil raised concerns about the long-term impact of the U.S. actions. Investors fear that if the oil from Venezuela flows into the market sustainably then it could add supply to an already oversupplied market.

* MCX Crude oil Jan is likely to rise further towards Rs.5230-Rs.5260 level as long as it stays above Rs.5100 level.

* MCX Natural gas Jan is expected to slip further towards Rs.290 level as long as it stays below Rs.320 level.

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631