Accumulate Delhivery Ltd For Target Rs. 431 By Geojit Financial Services Ltd

On track to deliver sustained growthDelhivery Ltd. is India’s largest fully integrated logistics provider. With a robust network spanning 18,700+ pin codes, 24 automated sort centres, and 57,000+ team members, it is revolutionising commerce through cutting-edge tech, world-class infrastructure and seamless logistics, delivering over 2 billion orders.

• Delhivery’s consolidated revenue saw a 5.6% YoY increase, reaching Rs. 2,192cr in Q4FY25, owing to increasing the Part Truckload (PTL) volumes. Indian operations contributed Rs. 2,191cr (+5.6% YoY). International revenue, which accounts for a tiny fraction, saw a sharp 184.1% YoY jump to Rs. 3cr.

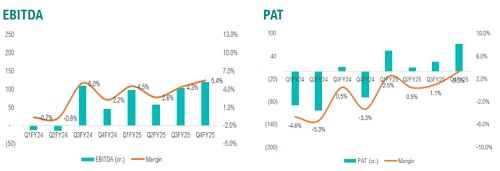

• EBITDA witnessed a substantial 159.5% YoY growth to Rs. 119cr, with a notable margin expansion of 320bps YoY to 5.4%, driven by higher volumes, enhanced operational efficiency across the networks and better fleet utilisation.

• As a result, the reported profit after tax (PAT) rose to Rs. 73cr, benefitting from lower tax expenses (-62.6% YoY) and a higher share of profits from its associate companies (+169.9% YoY).

• Delhivery's strategic initiatives drove steady performance in its core transportation businesses in Q4FY25, positioning the company for sustained momentum in FY26.

Outlook & Valuation

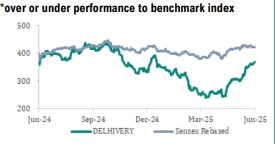

.Though the Express Parcel division still faces challenges, the impending acquisition of Ecom Express is likely to boost yields and margins by leveraging a broader network and operational efficiencies. Increasing PTL volumes without compromising on pricing, combined with the benefits of an integrated network, should result in a favourable margin trajectory in the long term. As the lowest-cost player, a position strengthened by the Ecom deal, Delhivery is well-poised to increase yields, enhance profitability and gain significant market share. Its rapid commerce service is also gaining traction from business-to-business customers seeking faster supply chain solutions. Therefore, we remain optimistic and assign an Accumulate rating on the stock, with a target price of Rs. 431, based on 2.7x FY27E P/S.

For More Geojit Financial Services Ltd Disclaimer https://www.geojit.com/disclaimer

SEBI Registration Number: INH20000034